[Image above] UNITECR 2017’s opening reception featured dancers representing the history and regions of Chile—from Easter Island, the Mapuche people, Spanish settlers, campesinos, and people from the northern regions, as well as the Patagonia region in the south. Credit: ACerS

The refractories industry gathered last week in Santiago, Chile, for the 15th Unified International Technical Conference on Refractories (UNITECR). The conference was organized and hosted by ALAFAR, the Latin American Refractories Association.

Pablo Valenzuela, president of this congress says, “I am most proud of two things. One, the Latin flavor in all the social matters, and two, the quality of the papers is really good.”

The organizing committee was selective in the papers it accepted. Valenzuela says, “We didn’t want a competition [with previous UNITECRs] on quantity of papers, but on quality. We wanted new subjects, new investigations, and technological advances.”

About 450 people attended this UNITECR from all corners of the world—Germany, United States, Argentina, Australia, Japan, China, Peru, Brazil, Spain, South Africa, and more—to hear 160 talks and view 14 posters (not including the inevitable last-minute cancellations).

The concurrent exhibition featured 15 vendors, who took advantage of the opportunity to meet face-to-face with their customers.

There were a number of students at the conference, including 12 graduate students (all from outside the U.S.) supported by ACerS Refractory Ceramics Division. ACerS RCD also provided funds, along with ASTM and TRI, for an undergraduate student from Clemson to attend UNITECR. For many, this was their first conference as well as their first international experience.

UNITECRs are unique meetings that mix engineering studies with industrial applications. As a result, economic influences are never far from attendees’ thoughts. This year organizers hit a nerve with their decision to focus on raw materials supply trends.

A key issue for refractory manufacturers is cost of raw materials, and the raw materials market has been volatile for the past several months. In September alone, the price of industrial alumina increased nine times—on average every four days! Similarly, the price of dead-burned magnesia for making MgO-C refractories has increased 170% in the last six months.

The timing of current events provided a perfect backdrop for the emphasis on raw materials. Valenzuela claims well-timed common sense. “As the owner of a refractory company, I know that raw materials are key to the industry, so they’re always at the ‘top level’ of the industry,” he says.

The raw materials market theme weaved through the conference, starting with the keynote speaker, economist Pedro Videla from IESE Business School in Spain. On the second day, Michael O’Driscoll of IMFormed continued the theme with a summary of the magnesia market, which impacts MgO-C refractory producers serving the steelmaking industry. On Friday, the technical conference closed with a panel discussion featuring top executives from refractory producers and raw material suppliers.

All three presentations pointed to the same source of rising costs: China. The Chinese government has implemented and is enforcing environmental standards that are constricting raw mineral supply. The government is at the same time clamping down and closing the robust illegal raw materials trade. Meanwhile, the usual wintertime slowdown in mining has begun, creating a three-pointed squeeze on the supply chain.

The commitment to environment is laudable, long-awaited, and necessary. However, with China holding such a dominant position in the global supply chain, alternative sources of minerals are insufficient or, in some cases, have been moth-balled and will take some time to reopen. The experts and corporate leaders were of the opinion that raw materials pricing would remain unstable and elevated through 2018 and possibly into early 2019.

In addition, the materials available to manufacturers are declining in quality, especially dead-burned magnesia and bauxite. Thus, manufacturers find themselves in a squeeze as steelmakers—driven by the automotive industry demand for higher quality steels—require higher quality and new types of refractories.

Remedies include recommissioning closed plants, increased vertical integration for companies with raw material assets, and more R&D to recycle refractories.

Despite the gloomy raw materials situation, the Latin influence and warm hospitality percolated through the entire meeting and kept spirits high—from opening cocktail reception with dancers representing the diverse zones of Chile, to the closing dinner, and companion activities. “We tried to have everything accessory very strong,” Valenzuela says.

The next UNITECR will be in Yokohama, Japan, in 2019, organized by the Technical Association of Refractories, Japan (TARJ). Will the raw materials markets be stable by then? Hard to say, but by then the refractory industry will have found a way to react and respond.

Pablo Valenzuela welcomes 450 international attendees to Unitecr 2017 in his hometown of Santiago, Chile. Credit: ACerS

Coffee, cookies, and conversation between sessions. Credit: ACerS

The Unitecr Expo provided companies an opportunity to meet with their customers face-to-face. Credit: ACerS

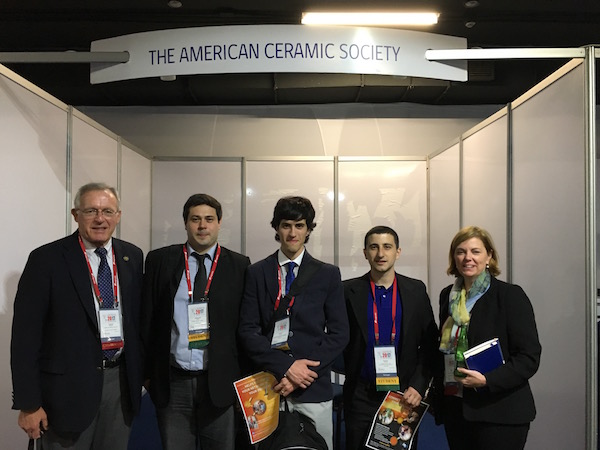

Industry champions, Charlie Semler (left) and Dana Goski (right) welcomed graduate students from Argentina. Students from left: Sebastian Gass, Walter Calvo, and Marcos Moline. Credit: ACerS