The future of Fisker Automotive’s luxury hybrid vehicle is unclear after DOE suspended its loan guarantee. That affects the fortunes of its vendors, including A123, supplier of the battery packs.

The short version of the story is that A123 is in something of a scramble mode thanks to the problems with Fisker Automotive’s DOE loan guarantee.

The story first came to light on Feb. 9 when, according to a Forbes report, Wunderlich Securities analyst Theodore O’Neill reduced his rating of A123 stock in reaction to a DOE loan guarantee to Fisker being put in hiatus.

So, what’s up with Fisker Automotive?

Fisker is a California-based start-up company that makes luxury hybrid cars and was started in 2007 by Henrik Fisker and Bernhard Koehler. In 2009 it received a $528 loan guarantee from the DOE, of which it has received $193 million so far, according to an online Reuters article, to support development of its first model, a luxury vehicle dubbed Karma. Also in the works is a sedan called Nina. In an email, FA spokesman Russell Datz says the company actually received two loans totaling $528.7 million: one for $169 million to support the Karma program, and the remainder to support Project Nina. He says the company has drawn all $169 million for the Karma and about $24 million for Project Nina.

The company built about 1,500 Karmas and delivered 400-500, including its first car, which went to investor and ecocelebrity, Leonardo DiCaprio, in July. Prospective customers must indeed have lots of (monetary) karma to purchase a Karma—they sell for upwards of $100,000.

Although some press reports claim DOE suspended the loan guarantee, according to Fisker, the delay in DOE funding was initiated by the company, itself. A company spokesperson says, “In May 2011, Fisker Automotive opted to stop taking reimbursements from the DOE while the company entered negotiations to implement more realistic and achievable milestones.”

Last week Fisker laid off 25 workers in its Delaware plant. The company says the 25 had been refurbishing the plant in preparation for Project Nina. The Karma is assembled in Finland and Fisker says the layoff is not directly related to its production or the company’s need for batteries.

Nevertheless, O’Neill suspects that the interruption of DOE funding is likely to result in reduced Karma production. In his research note, quoted in the Forbes article, he says lower Karma production “throws 2013 estimates [for A123] into disarray because Fisker has started laying off employees at its plant in Delaware and this would have been a much larger opportunity for A123 Systems.” O’Neill estimated that Fisker has about 2,000 battery packs in its inventory and implied that might be enough, “We can’t be sure when it [Fisker] will need more or if it will have the money to pay for it. In either case, we have to lower our revenue forecast [for A123].”

This is the third straight month of unfortunate developments for Fisker: In December 2011, they recalled 239 vehicles because of a possible defect in the batteries, and in January sales reportedly were stopped for four days to fix a software glitch.

Fisker was reported to be A123’s largest customer, and the battery pack is the most expensive component in the car. Forbes reported that O’Neill had downgraded his rating of A123 stock from Hold to Sell. In his research note explaining his analysis and recommendation, O’Neill said that the DOE loan guarantee has “become part of an intense political debate, [and] it may never be restored.” He sees this as part of the political fallout from the Solyndra hot potato, and that it sets up the possibility of “two Solyndras for the price of one.”

A Boston Globe article reports that about 60 percent of A123’s 2011 revenue came from the transportation industry. A123 seems to be working hard to make the best of a tough situation. The Globe says the company laid off about 20 percent of its Michigan workforce, affecting about 325 employees. However, since the problems arose with its Fisker business, it has raised $23.5 million from investors to fund its growth.

It’s a scary moment in A123’s history. Crain’s Detroit Business reported that the company’s stock fell almost 24 percent on Thursday following Fisker’s announcement that it was delaying the Nina project. That brings A123’s stock down by a sobering 80 percent in the last 12 months.

Jason Forcier, A123 vice president and general manager in Michigan prefers to see opportunity, saying in the Crain’s article, “This delay on the Nina project actually helps us by allowing us to pull our engineers to other programs.” A123 has recently reported several significant sales to power grid companies.

Forcier is not a lone optimist. The Globe reports that Deutsche Bank analyst, Dan Galves, sees the setback as significant, but temporary, saying, “We still see this company as having done very well in terms of carving out a position in the advanced lithium-ion battery market.”

Fisker, too, prefers to see the sunshine between the clouds. Founder Henrik Fisker is quoted in the Reuters story, “Our survival is not dependent on the DOE. We have already looked into alternative financing and we have really good possibilities.”

And, O’Neil may have it wrong with regard to Fisker’s future with the DOE. In the Globe article, a DOE spokeswoman says it “is working with Fisker to review a revised business plan and determine the best path forward so the company can meet its benchmarks, produce cars and employ workers here in America.”

If so, that would be encouraging karma for Fisker and A123.

[Editor’s note: Since first publishing this story, we received a note via email from Fisker spokesman and director of corporate communications, Russell Datz, providing some company background for the information contained in the news reports we quoted and linked to in the original version. This story has been updated to include Fisker’s point of view.]

Author

Eileen De Guire

CTT Categories

- Energy

- Manufacturing

- Market Insights

- Transportation

Related Posts

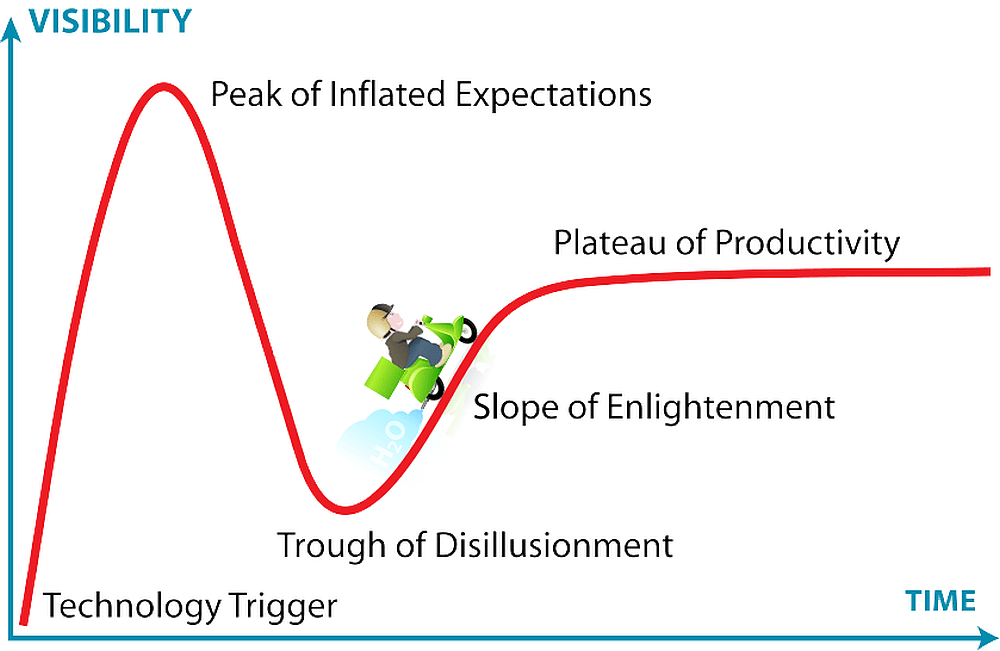

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025