According to new reports in BusinessWeek and Metal-Pages, China is cutting export quotas for the rare earths and metals – required in many advanced ceramic and glass applications – by 72 percent for the second half of 2010.

The BusinessWeek story predicts a trade dispute with the U.S. will result.

China, on one hand, argues that it has been undercompensated for these exports.

Liu Aisheng, director of the Chinese Society of Rare Earth is quoted in the BusinessWeek story as saying,

“The rare earths industry officials have realized that, after many years of continued growth in exports, the industry didn’t receive due profit returns. They adjusted the policy to ensure that the resources are optimally utilized.”

China has also said it also needs to guarantee supplies for its domestic industries. The country has also raised concerns about the environmental effects of mining for these ores.

But. Liu argues that the cuts, and presumably higher prices, will provide an incentive for outside producers to increase shipments and open new mines.

U.S. government officials, however, don’t seem to be buying that. BusinessWeek says that the “U.S. has asked business groups and unions to provide evidence that China is hoarding rare earths for a case that may be filed at the World Trade Organization, according to industry representatives who asked not to be identified.”

China is the major world exporter – and, arguably, the “market maker” – of rare earths and metals. Concerns about export restrictions really started to increase a year ago, and many nations, such as Japan, started to take aggressive steps (such as new trade pacts in Africa and recycling programs) to protect their industries. Unfortunately, the U.S. has been reacting slowly to this growing problem.

China’s Ministry of Commerce says shipments for the second half of 2010 will be limited to 7,976 metric tons, less than half of the amount shipped in the first half of the year (16,304 metric tons).

CTT Categories

- Electronics

- Energy

- Glass

- Market Insights

Related Posts

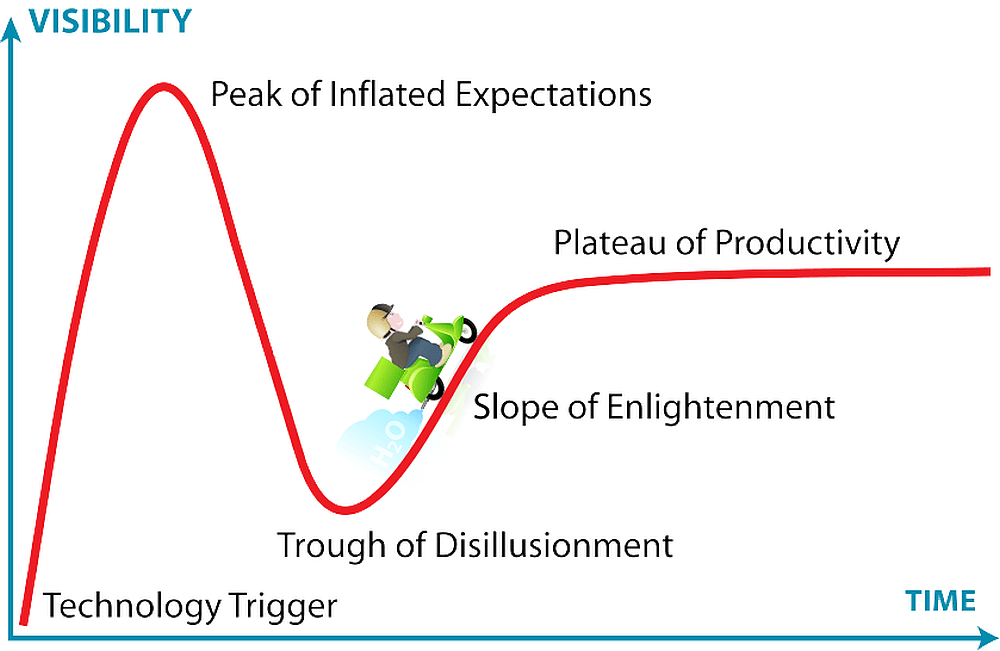

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025