Today was Bloom Energy‘s big media extravaganza and it seems like they were aiming for something on the order of what Apple or Microsoft would try to pull off. The stage was shared by big name politicians (Schwarzenegger and Powell) the online gods (Google and eBay), the movers and shakers in the investor class (Kleiner Perkings Caulfield & Byers and Morgan Stanley) and an impressive array of mega-brand customers (FedEx, Coca-Cola, Walmart, Staples and Bank of America).

Generally speaking this is all great stuff for those of us in the ceramics business. Incredible, really.

But what did anybody actually learn? Maybe that Bloom has a great marketing team? But, we already knew that was true based on Sunday’s exposure, courtesy of 60 Minutes.

What new information did we get about Bloom’s technology/engineering achievements and business plan? Not much.

It’s one thing to try to throw a coming-out party like Apple would. It’s another thing to pull it off when you have no track record of actually bringing an insanely great product to market at a price people are willing to pay, all while beating your competitors to the punch.

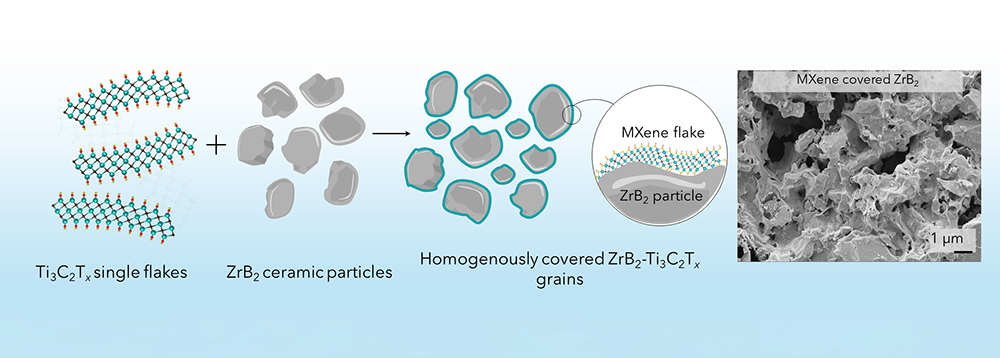

Some of the technology questions may be relatively easy. One expert tells me the ceramic electrolyte layer is is probably yttria-stabilized zirconia (YSZ), the green “ink” is NiO-YSZ serving as the anode (NexTech already offers an ink like this) and the black “ink” is a cathode layer made of lanthanum strontium manganite (LSM). What’s less clear is how Bloom solved stack expansion and seal problems that plague other SOFC makers. (Solved them in the sense that these units will perform reliably for years and years.)

But, Jonathan Fahey at Forbes, gets closer to the heart of the matter:

So while Bloom Energy may have some very promising technology to show off, we almost certainly will hear that its business hinges on a plan to lower the cost of its fuel cell by some large amount in some short period of time. It could be that Bloom Energy has the money and the brains to pull it off. Maybe it has already pulled it off. But if that business plan sounds familiar, it’s because that is the same refrain heard from solar companies, biofuels companies and fuel cell makers around the world.

[. . .]

It’s difficult to design components that can survive for decades in those conditions, especially the ancillary components that take the electricity out of the cell – for cheap. Then there’s the bugaboo of many a clean tech company: Designing a manufacturing process that can produce enough high quality devices to push costs down.

United Technologies produces a phosphoric acid fuel cell commercially and is working on a number of other fuel cell programs. Its fuel cell sells for $4,500 per kilowatt, and the company says it needs to get to $2,500 before it can be a real success

“We’ve figured out the durability problems,” says Mike Brown, a vice president at UTC Power, the United Technologies unit that makes fuel cells. “We haven’t figured out the cost problem yet.”

Fahey thinks that the unsubsidized cost of Bloom’s systems is about $9,000-$10,000 per kilowatt, so its not clear why Bloom’s units would be financially sucessful when UTC Power is struggling.

CTT Categories

- Electronics

- Energy

- Material Innovations

- Transportation