I first interviewed Ceradyne honcho Joel Moskowitz in 2009, and last week I ran into him again at the ACerS Ceramic Leadership Summit in Baltimore. There, the Ceradyne president and CEO mentioned that he had recently been interviewed by an online business magazine about some of his ideas about expanding and acquiring other enterprises.

I also had a chance to speak at length at the CLS with Ceradyne’s vice president of business development, Tom Cole, about the company’s business strategy. Cole said he came to Ceradyne (which makes everything from ceramic armor to materials for nuclear reactors to crucibles used by photovoltaic cell makers) in 2007 when it bought Minco, and when we spoke he struck me as surprisingly enthusiastic about global business and the opportunities to expand Ceradyne through purchases. I offhandedly asked Cole if that was because the economy had forced so many companies to be “on sale.” He quickly dismissed that notion and said Ceradyne was not looking into “distressed sales” and went on to explain how they were primarily interested in negotiating with businesses that could quickly fit in with the firm’s strategic plan.

I had planned on writing more about what Cole and Moskowitz had to say. But, coincidentally, the (lengthy) interview that Moskowitz mentioned is now published and available free online via the Smart Business website. Author Erik Cassano does a good job of having Moskowitz expound on his acquistions strategy and tactics, but also gets him to reveal more than I knew about how the company shifted, diversified and ultimately thrived by identifying and sticking with its core abilities.

Here is a taste of what Moskowitz had to say, but check out the whole article:

To seek out and effectively integrate new companies into Ceradyne, Moskowitz and his leadership defined an area of focus for the company’s technological muscle.

“We’ve always had a very clear idea that we make generally large structural ceramics,” Moskowitz says. “That’s different from the high-volume electronic ceramics that are used in ceramic capacitors, microwaves and semiconductor packaging.”

With those boundaries set, Moskowitz has empowered his key decision makers to scan different industries looking for potential targets of opportunity.

“We have a clear, pragmatic culture that starts with me,” he says. “I founded the company in 1967, and a lot of the process starts from that point going forward. Now that we’re a diversified global advanced materials company, every person in a key position is keeping their eyes open. In addition, we have myself and our president of North American operations working with our vice president of business development, and the goal is for us to get to a point where we’re acting in consensus on a given project.”

[…]

“Never bet the farm,” he says. “It has to be within reason of your resources. That is the first thing we always try to remember. The second is that, generally speaking, we want it to be within the framework of our core competencies in the areas of advanced technical ceramics and high temperature materials. Third, at least in our case, we want it to add value almost from the beginning. We’re not looking to complete somebody else’s research. We’re not looking for a turnaround. We’re looking to pay a fair price, generally in cash, and have the entity that we acquire add value from the beginning.”

CTT Categories

- Energy

- Manufacturing

Related Posts

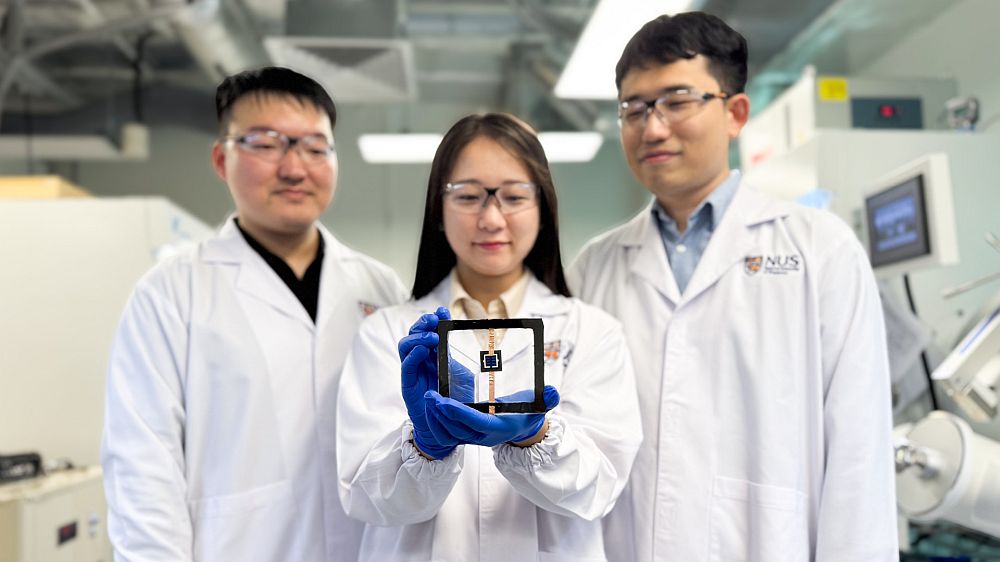

Solid-state batteries turn heads at CES 2026

January 29, 2026