[Image above] On Nov. 20, 2023, the office of New York governor Kathy Hochul announced that the first of 12 turbines in the South Fork Wind project had been installed. This array of wind turbines will be located off the coast of Montauk Point, Long Island. Credit: New York State Energy Research and Development Authority

As discussed in a CTT post from February 2022, the future of wind power is big, both figuratively and literally. In addition to growing investments in the wind sector, wind turbines have grown physically larger since the early 2000s, allowing them to capture more wind and produce more electricity.

Credit: Real Engineering, YouTube

In the past year, however, the wind sector has experienced some setbacks compared to other renewable energy technologies. According to BloombergNEF’s 2H 2023 Renewable Energy Investment Tracker report, onshore wind investment has declined for four straight quarters. The report attributes this decline to grid constraints, permitting challenges, and faltering policy support, which leads to a reduced pipeline of ready-to-develop projects.

The BloombergNEF report noted that offshore wind investment fared better, posting a strong 47% increase relative to the first half of 2022. But the translation of this investment into tangible products is not such a rosy picture, as detailed in a CNBC article earlier this month.

As the CNBC article explains, specialist wind energy firms often find themselves outbid for seabed licenses by traditional oil and gas players. If they do win a contract, electricity prices are often too low to justify the manufacturing costs, “leaving companies looking to their governments in Europe and the U.S. to deliver greater subsidies and restore balance to the market.”

This situation puts projects at risk of being abandoned if governments do not offer the support that wind energy firms believe is necessary for project completion. Such a situation is already playing out with several projects along the East Coast of the United States, as detailed by The New York Times.

The most egregious example occurred on Oct. 31, 2023, when Danish energy developer Ørsted backed out of two projects off the southern coast of New Jersey, citing “macroeconomic factors” such as inflation and rising interest rates. The news generated a lot of anger because the state had already approved a tax break to let the company keep as much as $1 million in tax credits that otherwise would have been returned to electricity ratepayers.

The fact so many wind energy firms are now attempting to renegotiate their contracts for established projects is due to several economic factors, as explained by Jacob Pedersen, senior analyst at Sydbank, in the CNBC article.

“We know a huge part of the problem is related to the projects that were won back in 2019/20 and at low prices. Since then, inflation and interests have gone up, it’s become much more expensive to realize these projects, and that has left an order book of deficits, and that order book is now being smaller and smaller as time goes by,” he says.

Pedersen argues that there is a “huge need for recalibration” on the cost of the planned energy transition, but there are indications that governments are taking action. For example, several offshore wind projects launched in the last year were awarded on “much, much better terms,” according to Pedersen, which should allow companies to generate a profit in the future.

Some older projects are still proceeding as planned, however, despite the setbacks described above. For example, Ørsted confirmed it will proceed with construction of the South Fork Wind project, an array of 12 offshore wind turbines along Montauk Point in Long Island, New York. As of Nov. 20, 2023, the first turbine in this array has been installed.

Author

Lisa McDonald

CTT Categories

- Energy

- Market Insights

Related Posts

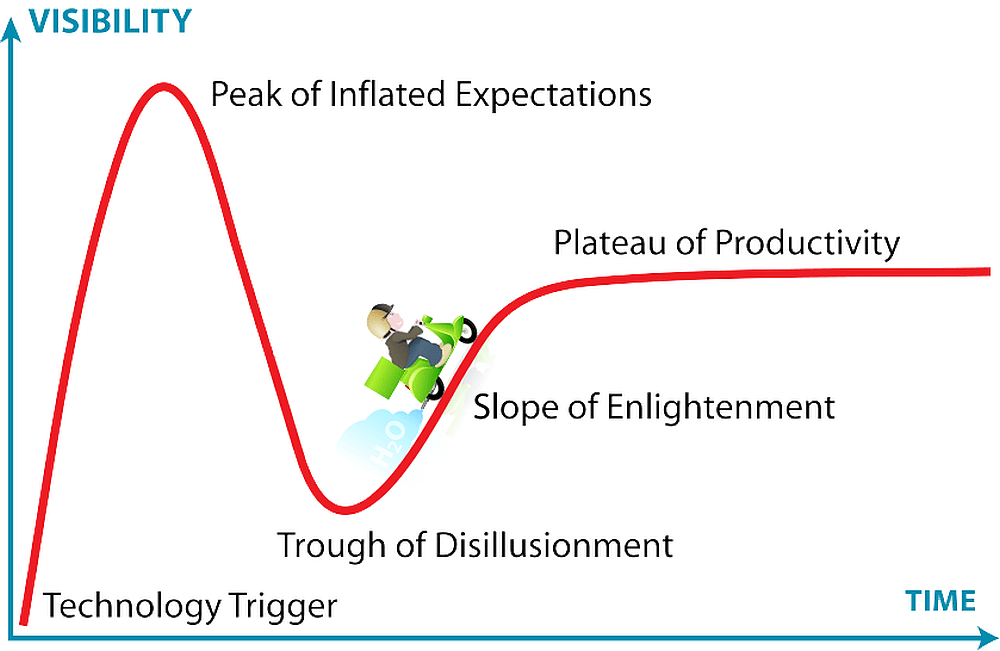

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025