Recent developments around the world related to rare earth elements continue to suggest that strategic concerns are being supplanted by shorter-term economic, environmental and technical considerations, all of which are adding together to put tensions over REE supplies on the back burner.

In no particular order, here are some of the major news items that are coming into play.

• For the previous six years, China has been pulling back on the amount of rare earth mining and exports, but that changed last week when the nation surprised some observers by actually increasing the total export tonnage for 2012. According to a story (sub. req’d) in the Wall Street Journal, the amount of the increase wasn’t huge, about 2.7 percent, and it probably won’t make a difference anyway because demand for exports have declined significantly.

The period of restricting exports (which paralleled sharply rising prices) was triggered by many causes, many of which are still being debated among business and economic circles. But, clearly, two significant and linked considerations stimulated Chinese officials in the past to impose restraints. The first, was (and still is) China’s desire to cut down on REE-related environmental damage and bootleg deals, the most onerous of which have been small and corruption-prone mines. The second is China’s desire to ensure a short- and long-term supply of REEs for the nation’s humming energy, transportation and electronics industries. To accomplish both, China combined sharp export limits with promulgation of new environmental and business regulations. These moves have consolidated most, if not all, of REE mining and refining to a limited group of certified companies. However, tough regulations and falling prices (due to falling international demand) have meant that even “blessed” REE producers in China are unable or unwilling to meet their theoretical export quota, and, according to a Bloomberg story, REE exports have actually declined—regardless of the export ceiling—by 36 percent this year.

• Although the US has taken allegations of unfair REE trade practices by China to the WTO, the above mentioned shortfall in the sales of exports has taken much of the wind out of the WTO pleadings. Demand for REE supplies by US, European and Japanese manufacturers has dropped considerably as each of these geographic regions endure unpredictable economies and significant drops in consumer spending ability. With China’s REE trade restrictions easing, another bit of nasty fallout is the financial effect on REE mining enterprises outside of China. After China raised the export limit, sector business analysts immediately slashed the value of the US-based Molycorp, which had already been struggling to mount significant competition to China. For example, JP Morgan Chase immediately lowered its estimated value of a share of Molycorp by 35 percent (from $11.50 to $8.50), a gloomy sign for a company that wants to a vertically integrated RE provider and consumer. Australia-based Lynas Corp. has also seen its share price beaten down in the past 30 days (see chart at top), unfortunate news for a company that also has had the opening of a major refining plant in Malaysia repeatedly delayed. Vertical integration and new refining initiatives are tough to swallow when falling prices play havoc with the mathematical models of the present value of future revenues and internal rates of return.

• There is a new alternative to traditional REE mining (new to me, at least). I ran into this when I saw an announcement about a presentation made last week at the recent ACS meeting about progress being made by researchers at Oak Ridge National Lab in extracting uranium from seawater. In brief, an ORNL group has been experimenting with special high surface area, high-capacity (“HiCap”) fibers. According to Chris Janke, one of the inventors and a member of the lab’s Materials Science and Technology Division, “HiCap effectively narrows the fiscal gap between what exists today and what is needed to economically extract some of the ocean’s estimated 4.5 billion tons of uranium. Although dissolved uranium exists in concentrations of just 3.2 parts per billion, the sheer volume means there would be enough to fuel the world’s nuclear reactors for centuries.” HiCap fibers have also been used to extract other toxic metals from water.

Janke goes on to explain how the fibers work. He says, “Our HiCap adsorbents are made by subjecting high-surface area polyethylene fibers to ionizing radiation, then reacting these pre-irradiated fibers with chemical compounds that have a high affinity for selected metals.” He says the uranium is extracted from the fibers using an acid elution method, and the fibers can be regenerated and reused.

So, it slowly dawned on me that if they can use HiCap to extract uranium, why not rare earths? Indeed, it turns out that HiCap fibers are a candidate for REE extraction. Just to be clear, ORNL HiCap fibers were manufactured by a custom spinning company in Florida, Hills Inc., in conjunction with the lab. And, in a prescient move, late last month R&D Magazine recognized Hills Inc. and ORNL as joint recipients of a 2012 R&D 100 award for using the fibers to extract a variety of metals. But, Hills Inc. is a specialty spinning company, not a materials developer. Regrettably, the R&D award omitted the significant development role of another company, the Australia-based Water Resources Group and WRG’s Campbell Applied Physics division.

Once I got directed to WRG/CAP, it didn’t take much to turn up mention in the company’s April 2012 quarterly report that

[T]he Company is investigating the application of its O3CD System to economically extract and separate rare earth elements, which have become increasingly important in the defense, alternative energy and communications industries. The project will be developed in cooperation with the US Department of Energy’s largest science and energy laboratory, Oak Ridge National Laboratory. Further commercial agreements are expected to follow in the near term, which may involve WRG entering into a joint venture to share the revenue from the sale of the rare earth metals.

The company’s most recent annual report (PDF) also provides some revealing information.

Recent meetings between ORNL and CAP have focused on investigation of optimum techniques for identification and extraction of REE. A combination of CAP’s O3CD front end system, employing a REE optimized [capacitive desalination], followed by one of several candidate separation technologies from ORNL could enable economical extraction of REE as metal sulphides, metal oxides or zero-valence metals. … CAP and ORNL recognize the opportunity for combining their resources to demonstrate their first-rate capabilities in extracting REE from waste streams on a commercial scale, and to develop a new, reliable source of these materials for the United States. In order to fast track testing, CAP will have access to the $1.4 billion Spallation Neutron Source facility located at Oak Ridge. This unique facility provides the most intense pulsed neutron beams in the world for scientific research and industrial development.

Interesting!

CTT Categories

- Electronics

- Energy

- Material Innovations

Related Posts

Sports-quality ice: From pond side to precision Olympic engineering

February 12, 2026

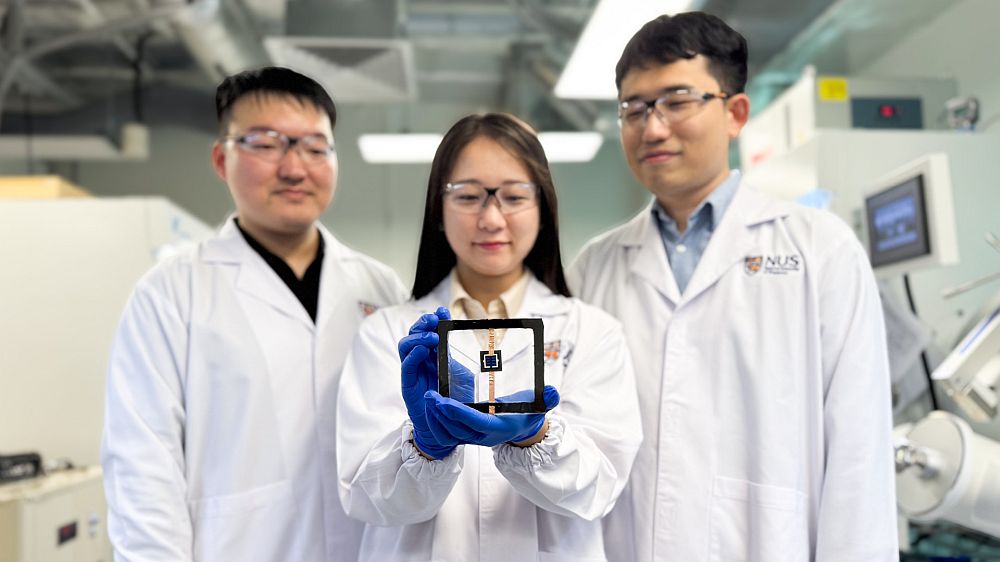

Solid-state batteries turn heads at CES 2026

January 29, 2026