The most recent edition of China’s Refractories magazine (published by the Luoyang Institute of Refractories Research) reports a some interesting changes in the trends in basic manufacturing in the nation.

For example, CR reports that the total output of China’s refractories industries dropped over 13% in the period of Jan. 09 – Sept. 09 compared to the same period in 2008. The production of dense-shaped refractory products (about 3/5 of the total) dropped 11% and monolithic refractories (about 1/3 of the total) dropped 18%. Similarly, the country’s import of alumina- and silica-based raw materials (e.g., bauxite) is down nearly 15% in the nine-month period.

On the other hand, China’s total alumina imports have increased nearly 17% in the corresponding period. The magazine doesn’t say it, but the obvious conclusion is that much of the alumina is going to aluminum production and not refractories. Aluminum output in China is expected to grow by 9% in 2010.

Although China has internal bauxite resources, it’s internal demand has exceeded this supply for some time, and the country depends primarily on Australia but also to a lesser extent on India for alumina imports. This enormous demand for alumina has pushed up trading prices for these raw materials and these price hikes have caused complaints by American refractory makers.

On other fronts, China’s cement output increased 18.2% in the first three quarters of 2009, and flat glass output increased by nearly 2%. While both of these materials are barometers of construction and building activity, the noticeable difference in the two amounts appears to be primarily due to existing high inventories of flat glass products. These glass inventories dropped nearly 30% in the same period.

Interestingly, CR reports that while crude steel product production increased over 10% in the first ten months of 2009, it says that, “Higher output is increasingly distorting the supply and demand position and crippling the margins of enterprises…The problem of overcapacity may get worse between the fourth quarter of 2009 and early 2010.”

However, the overcapacity situation is not expected to last long. China’s entire building industry is expected to benefit from massive government infrastructure spending on railroads, highways, airports, irrigation projects and rural infrastructure. Some estimates of the infrastructure projects report that nearly $.6 trillion will be spent.

. . . adding, lest anyone be confused, what China means by “infrastructure investments” and how the folks in Washington, DC use the same words are worlds apart. h/t to Atrios.

CTT Categories

- Construction

- Energy

- Market Insights

- Transportation

Related Posts

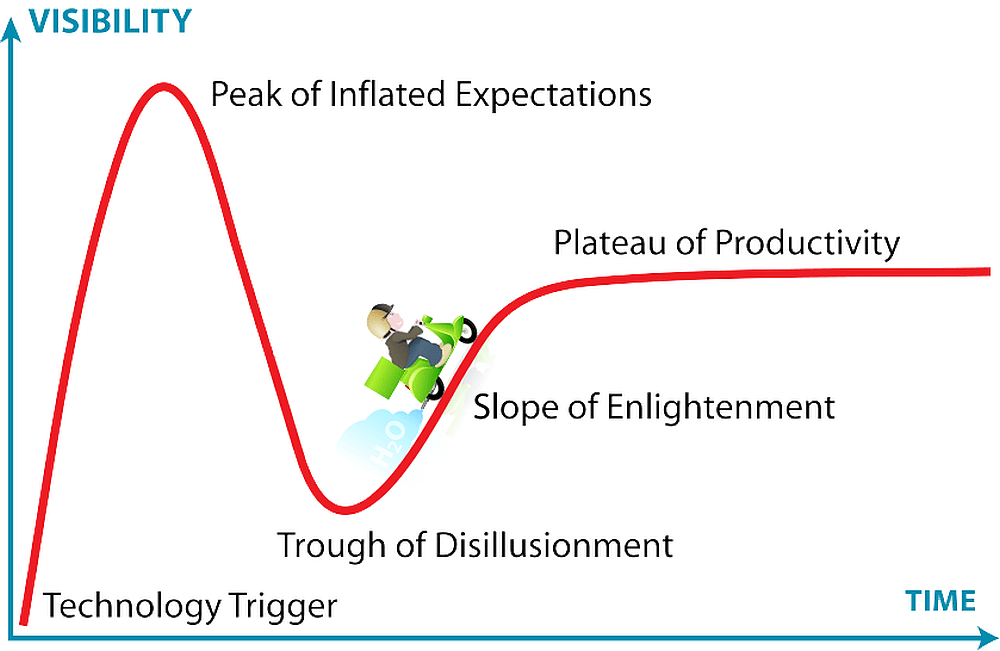

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025