A study released last Friday indicates that, despite popular perception, fossil fuels get the lion’s share of U.S. energy subsidies, and that much of those subsidies are going to aid non-U.S. oil production.

The Environmental Law Institute, in partnership with the Woodrow Wilson International Center for Scholars, reviewed fossil fuel and energy subsidies for Fiscal Years 2002-2008. They found that fossil fuel subsidies amounted to $72 billion over that period. Subsidies for renewable fuels were only $29 billion in the same time period, and $16.8 billion went to corn-based ethanol production. (Nuclear energy data was not included in the research.)

The ELI says the fossil fuel subsidies come in a number or forms:

The subsidies examined fall roughly into two categories: (1) foregone revenues (changes to the tax code to reduce the tax liabilities of particular entities), mostly in the form of tax breaks, and including reported lost government take from offshore leasing of oil and gas fields; and (2) direct spending, in the form of expenditures on research and development and other programs. Subsidies attributed to the Foreign Tax Credit totaled $15.3 billion, with those for the next-largest fossil fuel subsidy, the Credit for Production of Nonconventional Fuels, totaling $14.1 billion. The Foreign Tax Credit applies to the overseas production of oil through an obscure provision of the U.S. Tax Code, which allows energy companies to claim a tax credit for payments that would normally receive less-beneficial treatment under the tax code.

“The combination of subsidies – or ‘perverse incentives’ – to develop fossil fuel energy sources, and a lack of sufficient incentives to develop renewable energy and promote energy efficiency, distorts energy policy in ways that have helped cause, and continue to exacerbate, our climate change problem,” notes ELI Senior Attorney John Pendergrass. “With climate change and energy legislation pending on Capitol Hill, our research suggests that more attention needs to be given to the existing perverse incentives for ‘dirty’ fuels in the U.S. Tax Code.”

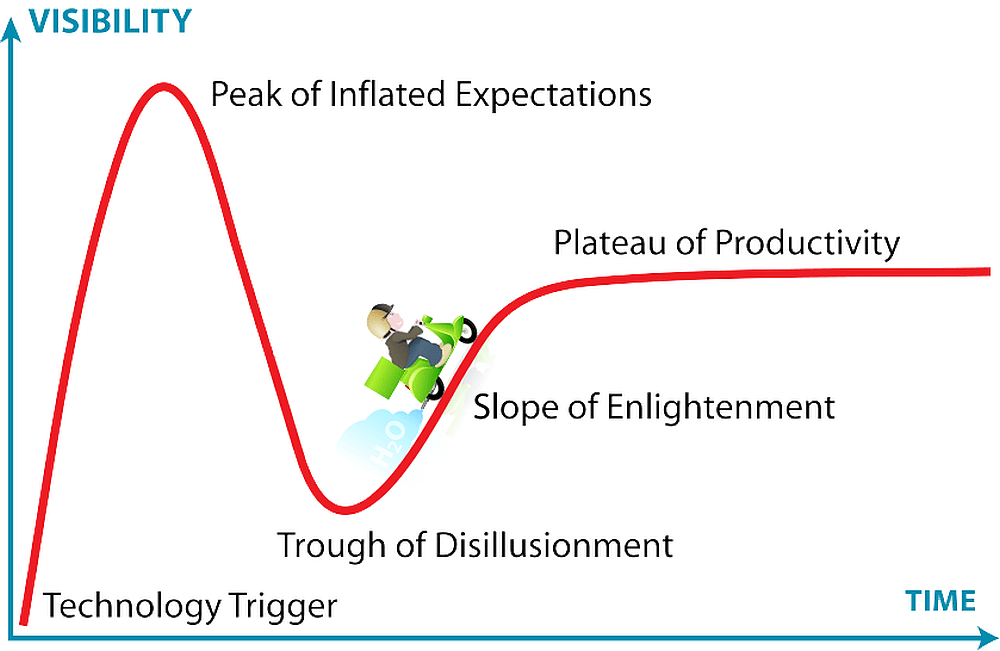

For an explanation and notes regarding the above graphic, click here for a full version (pdf).

[UPDATE] – The AP reports that President Obama is calling for a global elimination of subsidies for fossil fuels.

CTT Categories

- Energy

- Market Insights

Related Posts

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025