A few days ago, Xinhua News agency reported that three rare earth mining districts near Ganzhou city have been order to halt production by year-end. In fact, production at one of the mines has been halted already, according to Li Guoqing, director of the city’s mining management bureau.

This is a huge problem, because, as Japan’s Nikkei news service reports, Ganzhou is the #1 producer of dysprosium. Dysprosium plays a critical role in many clean energy technologies and is one of the elements the DOE has highlighted as being of critical concern in regard to future supply disruptions and affects on critical technologies. The DOE is also concerned because dysprosium has no suitable replacement.

Ganzhou is also the producer of other heavy rare earths.

Nikkei also reports that it believes all three mines have exceeded their annual quotas, and production will likely be suspended at least until the end of the year.

Continuing with the Xinhua story, it says:

It is unknown when production will resume, as they have to wait for directives from the provincial government, Li said. The notice also told the counties to set production quotas to rare earth mines to prevent over-exploitation. …To control environmental damage and protect resources, China has announced various policies, such as suspending the issuance of new licenses for rare earth prospecting and mining, imposing production caps and export quotas, and implementing tougher environmental standards.

It’s not yet clear to me how the US and its business community will react, but the Nikkei story reveals some of the responses in Japan:

Mitsubishi Electric Corp. and some other major Japanese producers of electrical machinery have started raising air conditioner prices because of surging prices for dysprosium.

“There are efforts to kick off (dysprosium) production in Russia and Vietnam, but it will likely take at least five years,” said Nobuhiko Kawamura, general manager of Showa Denko KK’s rare-earths division. The firm, which produces dysprosium-based alloys in Jiangxi Province and elsewhere, sees potential for global dysprosium supply shortages in two to three years should China continue with its strict regulation of rare-earth production.

Even so, magnet manufacturers and other firms with dysprosium dealings mostly reacted to Monday’s news with calm. “Because we thought it might happen, the news comes as no surprise to us,” said a official at Hitachi Metals Ltd., the leading maker of rare-earth magnets.

But a major trading house is alarmed because it will not likely be able to find alternative sources of dysprosium and other rare-earth metals quickly.

Stay tuned.

CTT Categories

- Construction

- Electronics

- Energy

- Market Insights

- Transportation

Spotlight Categories

- Member Highlights

Related Posts

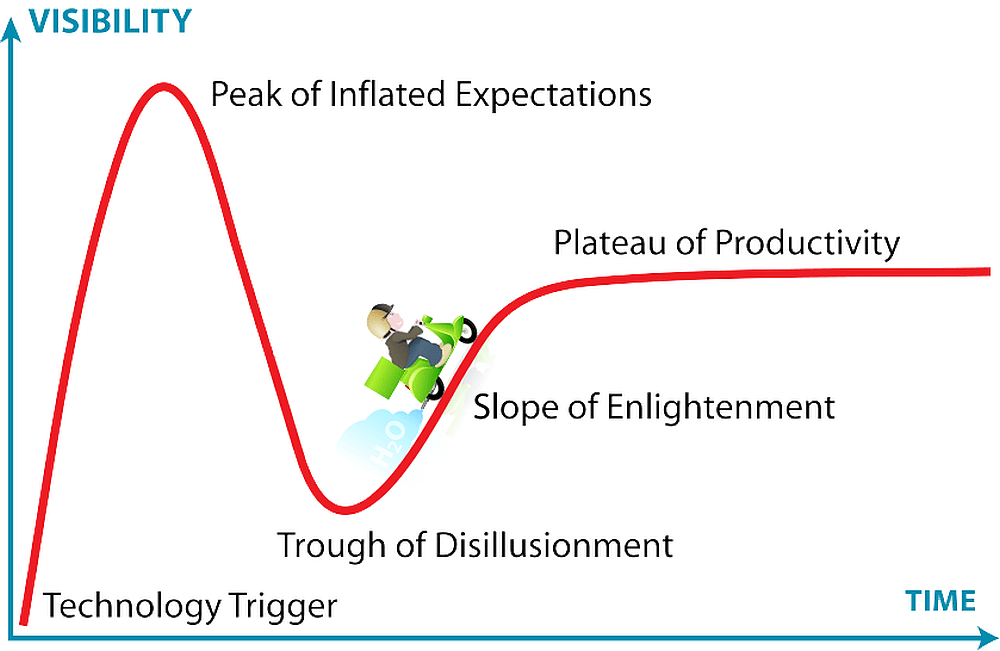

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025