[Image above] Credit: The Freedonia Group.

The 3.3 percent per year growth rate for US refractory sales that has just been predicted by a respected market research group through 2016 isn’t blistering—but I think most in the industry would take steady growth over the alternative.

According to market research by the Freedonia Group, refractories sales in the US will grow to $2.6 billion by 2016. The company attributes much of the expansion to growth in US steel output, plus resurgence in the production of ceramics and glass for nonresidential construction. It reports that iron- and steel-related refractory sales in 2011 was slightly under $1 billion, the equivalent of about 45 percent of all refractory sales in the nation.

For me, one of the most interesting aspects of Freedonia’s report is that it identifies a “good news—bad news” trend that is going to serve as a brake on refractories growth. The report says that refractory sales will continue to shift toward the selection of premium-priced, advanced refractories. On the other hand, one of the main reasons purchasers are interested in buying advanced refractories is that they are more durable and have a significantly longer in-service life. Freedonia say, “Most materials manufacturing industries have reduced their per-production-unit consumption of refractories by using these newer, more durable products and improved processes.”

Although iron/steel sales will be strong, Freedonia’s researchers expect that the fastest gains of any market (in dollar terms) will come from the nonmetallic materials sector, such as ceramics, glass, and cement producers. Other nonmetallic demand will come from waste-to-energy plants and traditional power plants.

Another way to look at future refractory sales is in terms of the form factor. For example, Freedonia believes that monolithic refractories and specialized shapes will lead the market. Again, the report suggests that buyers will continue to specify specialized, high-grade refractories. The net effect, according to the company, will be that “demand for nonclay refractories, in tons, will outstrip that for clay refractories due to the better performance offered by nonclay types.”

The future isn’t bleak, however, even for clay refractories. Freedonia also forecasts that “the sales of clay refractories will shift toward higher grades, spurring value gains such that demand for clay types (in dollar terms) will rise at a faster pace than sales of nonclay refractories.”

The report also evaluates company market share and profiles industry competitors such as ANH Refractories, Cookson, Magnasita, Minerals Technologies, RHI, and Saint-Gobain.

CTT Categories

- Energy

- Manufacturing

- Refractories

Related Posts

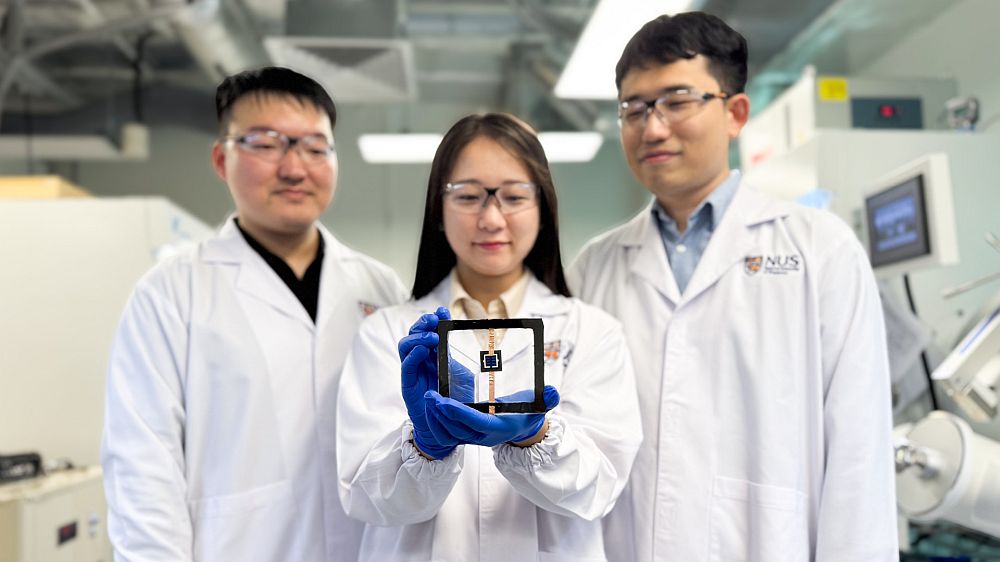

Solid-state batteries turn heads at CES 2026

January 29, 2026