I am going to lunch with Secretary Steven Chu this coming week and I am anxious to know if he is even aware of these stats from his department, and, if so, does he plan on recalibrating his spending commitment. (And, yes, I do understand that wanting to “do things different” and actually figuring out how to do things different, especially when you are picking up the rubble from an anti-funding administration, is really really hard. But, at some point it becomes important for the DOE leaders to shift from talking about their commitment to funding science and focus, you know, on writing those checks.)

Actually, I am more interested if Chu is thinking about recalibrating his commitment to Matt Rodgers, who Chu specifically assigned to be responsible for establishing a new “process for issuing direct loans, loan guarantees and other funding to make it faster, simpler and more accountable.” Either Rodgers speaks up to reveal what the heck is going on behind the scenes and where the holdups are, or he needs to walk.

In an effort that strikes me as trying to put lipstick on a donkey, here is what Rodgers recently told Congress’s (from his July 14, 2010 testimony, emphasis added);

“The Department has outlaid more than 16 percent ($5.2 billion) of our Recovery Act funds, and our primary focus now is accelerating our outlay rates to our 5,000 recipients. . . . We will soon be operating out our target rate of $800 million a month. You might think of this process as analogous to accelerating onto the highway: go too quickly and you risk a mistake; go too slowly and you won’t get to your destination on time. At our optimal pace, we will be at able [sic] to minimize risk to taxpayers, while maximizing their return in jobs created or saved and projects accomplished. By the end of the fiscal year, we expect to have outlaid about $8 billion.“

Keep in mind that Chu promised Feb. 19, 2009, to “disperse 70 percent of the investment from the American Recovery and Reinvestment plan by the end of next year,” i.e., ~ $25 billion by Dec. 31, 2010. More importantly, everyone needs to be honest and acknowledge that there is minimal risk to taxpayers, and this one task is not equal to the other task of “maximizing the return in jobs created or saved and projects accomplished.” That confusion is part of the way double-dip recessions are ushered in. The Bush administration used “tax payer risk” as an excuse to never write checks to many in the science community. The old theme of “change” was supposed to invert a lot of this nonsense, not level the playing field of risk and return.

CTT Categories

- Energy

- Market Insights

Related Posts

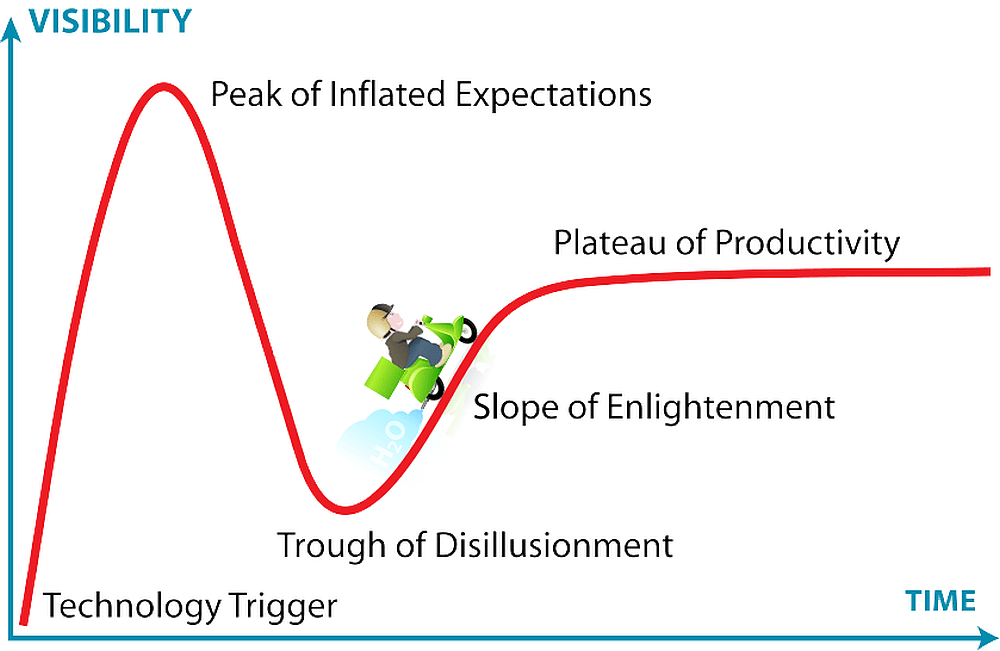

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025