Turns out, Bill Gates was right.

A few weeks ago we told you about an interview Gates did at the Wall Street Journal’s ECO:nomics conference. One of Gates’ points was that subsidies to support alternative energy technologies is not sustainable. Instead, he’d like to see the money go into R&D to make the new technologies efficient and independently sustainable. At present, he said only 2 percent of government funding is going to R&D, with the rest going into subsidies and tax credits.

This week, we got an indication of how energy subsidies impact the fortunes of companies, and what happens when they end.

According to a story in yesterday’s Toledo Blade, First Solar (Tempe, Ariz.) announced it is reducing its workforce by 30 percent, closing two plants in Germany (1,200 jobs) cutting four of 20 manufacturing lines in Malaysia (550 jobs). While no plants in the US are slated for closing, the company is reducing its workforce here, too, laying of 20 administrative staff in its Toledo-area facility. The company was started in Toledo, Ohio as Solar Cells Inc.

The Blade article says the closures were triggered by the elimination of subsidies for the solar-panel industry. Mark Widmar, CFO for First Solar was quoted, “In recent months, we have seen this trend continue and even intensify as European policy makers have proposed and implemented significant reductions in solar subsidies.” He said that business in Europe “is not viable without significant subsidies.”

In a First Solar press release, Mike Ahearn, company chair and interim CEO implies that subsidies encouraged overinvestment in manufacturing capacity. He says, “After a period of robust growth, First Solar is scaled to operate at higher volumes than currently exist following the reduction of subsidies in key legacy markets. As a result, it is essential that we reduce production and decrease expenses to reflect the smaller volume of high-probability demand we forecast. These actions will enable us to focus our resources on developing the markets where we expect to generate significant growth in coming years.”

Last Friday, Nasdaq management announced that First Solar would be removed from the Nasdaq 100, according to another Toledo Blade story, because it failed to meet Nasdaq’s market capitalization benchmarks.

A Nasdaq story reports that the subsidies issue has a global reach, “First Solar … has seen its fortunes decline amid fierce competition from well-financed rivals in China that have grown quickly and competed in markets where demand has been largely dependent on government subsidies.”

In the press release, the company explains that the restructuring is expected to save $30–60 million this year, and realize savings of $100–120 million annually in the future. The company is projecting that the streamlining will reduce per-watt manufacturing costs of a panel to 70–72 cents, less than the previously expected 74 cents in 2012, and to 60–64 cents in 2013.

First Solar’s technology is based on thin-film cadmium telluride deposited directly on glass panels.

Author

Eileen De Guire

CTT Categories

- Energy

- Market Insights

Related Posts

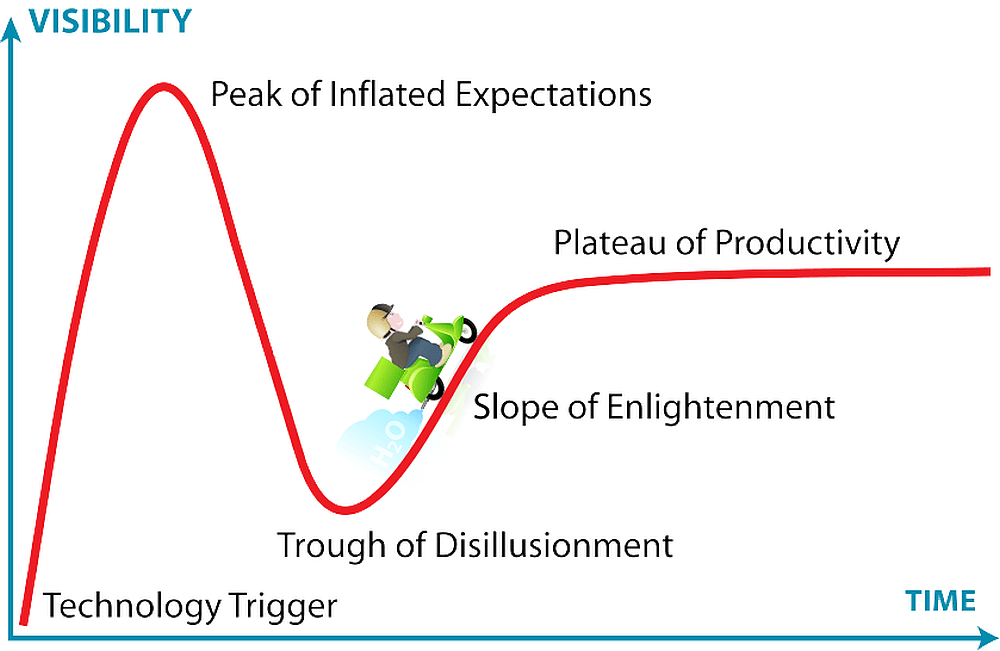

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025