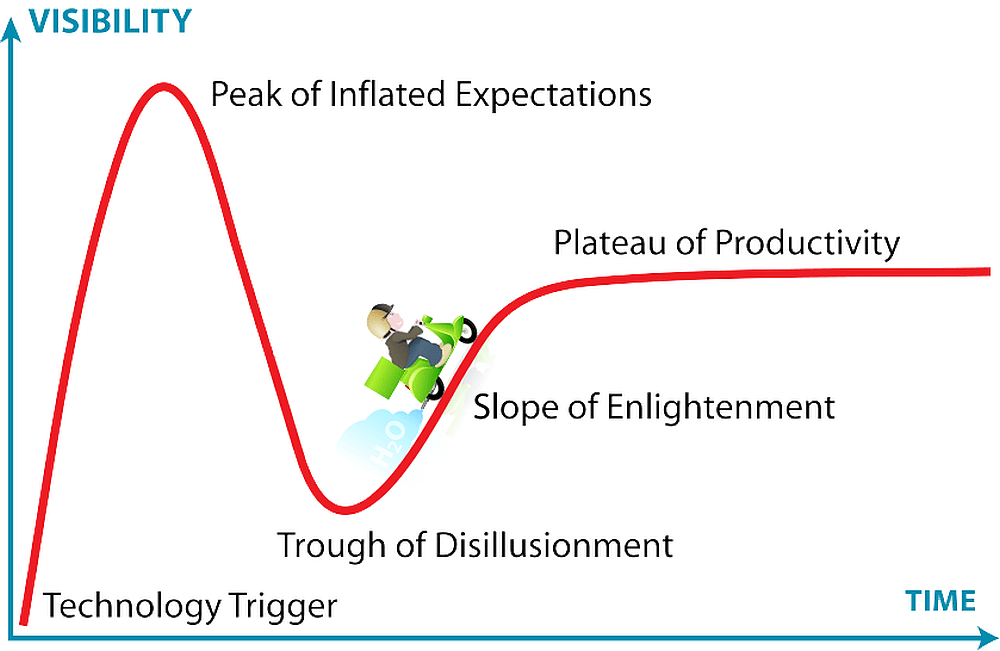

[Image above] The Gartner Hype Cycle is a good way to conceptualize the current development of hydrogen bikes. Credit: Jeremy Kemp, Wikimedia (CC BY-SA 3.0); Drazbedel, Shutterstock

Just in time for this year’s Tour de France, we are going to take you on a two-wheeled adventure into the innovative saga of hydrogen-powered electric bikes.

You may be familiar with the Gartner Hype Cycle, which provides a graphical representation of the maturity and adoption of a technology or innovation over time. Hydrogen bikes are currently somewhere in the Trough of Disillusionment. Will they ever start the climb up the Slope of Enlightenment?

Today’s CTT describes how hydrogen bikes got to where they are currently and where they might be going in the future. Just like the mountain stages of the Tour de France, there will be surprises and upsets along the arduous way. (No yellow jersey spoilers, either.)

Technology Trigger: Sparking a sustainable idea

Electric bikes (e-bikes) are not a new concept. As soon as the Rover Safety bicycle made its debut in 1885, offering all the core features of standard modern bicycles, inventors were looking for ways to strap an electric motor on it. In 1895, Ogden Bolton Jr. was awarded a U.S. patent for a DC-motor powered electric bike. But for many years after that, e-bikes remained experimental and heavy due to their lead-acid battery power sources.

The oil crisis of the 1970s prompted additional research into e-bike designs. But e-bike technology did not really take off until the early 2000s when lithium-ion batteries , which became commercially viable in the early 1990s, started being used.

As with electric vehicles, e-bikes have the drawbacks of long charging times and limited ranges. On average, an e-bike battery needs 3 to 6 hours to fully charge, and that charged battery will take you 20 to 50 miles (30 to 80 km), depending on how much you like to pedal.

Hydrogen fuel cells could provide a solution to the challenges of long charging times and limited ranges. Rather than relying on stored electricity, like battery-powered e-bikes do, fuel cells function like an onboard power plant that produces electricity upon demand. Relying on stored fuel rather than stored electricity can allow for faster refueling, greater range, and potentially a longer lifespan.

Hydrogen fuel cells have been used in mass-produced vehicles for almost the last two decades. Compressed hydrogen has an energy density of 120 MJ/kg, approximately three times that of oil, making it an attractive fuel source. In addition, modern hydrogen fuel cells are two to three times as efficient as gas-powered internal combustion engines.

Regarding the use of fuel cells in bicycles, early hydrogen bikes were first prototyped in 2000, but the rapid development of modern hydrogen fuel cells in the 2010s were the true Technology Trigger for hydrogen bike technology. This development accelerated hydrogen bikes into the next stage of the Garter Hype Cycle: the Peak of Inflated Expectations.

Peak of Inflated Expectations: The rise, fall, and resurgence of Youon Technologies

Chinese cities have leaned hard into hydrogen bike sharing programs, in part because of safety concerns around lithium-ion batteries. But even in such a large market of urban centers as China, hydrogen bikes have struggled to overcome barriers to commercial adoption.

For example, a June 2024 article in the South China Morning Post detailed the rollout and subsequent recall of shared hydrogen bikes in Shanghai using stock supplied by Youon Technology. This Chinese bicycle systems manufacturer is by far the most established company in the hydrogen bike space, so the recall had an immediate impact.

As of March 2025, however, it appears that Youon Technology’s fortunes have reversed. It is under new leadership and new ownership. A subsidiary of Hello, China’s largest bike-sharing provider, is becoming the majority shareholder in Youon Technology.

Trough of Disillusionment: Commercial adoption of hydrogen bikes

As with other innovations, the biggest hurdles to hydrogen bike commercialization are infrastructure, technology maturity, cost, and market readiness.

Infrastructure

The biggest hurdle to hydrogen bike commercialization is the infrastructure for storing the compressed hydrogen gas that fuels and refuels the bikes. Large quantities of compressed hydrogen are often stored in high-pressure tanks made of advanced composite materials to be as lightweight and strong as possible.

The current state-of-the-art tank type consists of a polymer liner for impermeability under a full composite wrap. These tanks are used for both hydrogen bikes and vehicles. The smaller tanks in hydrogen bikes may even be replaceable cartridges.

The hydrogen refueling network is extremely limited. As of this writing, the only commercial hydrogen refueling stations in the United States are in California. Industrial hydrogen can be purchased from gas suppliers, but those suppliers typically require large bulk purchases. Their hydrogen is also more likely to be a byproduct of fossil fuel production, which negates the point of using so-called clean hydrogen in the first place.

Technology maturity

Another barrier is technology maturity. Each hydrogen fuel cell has a low power capacity (typically less than 1 V), so they are packaged in stacks of multiple fuel cells to supply enough power to the bike. Efforts toward improved power density continue, specifically with the aim of miniaturization. Higher power density makes smaller fuel cells possible, which increases their application in smaller vehicles, such as drones.

Ceramic materials are used in hydrogen polymer electrolyte membrane fuel cells (PEMFCs). They find applications as catalyst supports or potentially ceramic cages to easily store and release hydrogen. The development of novel ceramic materials may help improve the efficiency, durability, and cost effectiveness of fuel cell technology in the future.

Cost

Cost is the third challenge to widespread hydrogen bike adoption. The production cost of green hydrogen (from renewable sources by hydrolysis) is much higher than that of hydrogen from steam-methane reforming or biogas reforming. Unlike coal or oil, hydrogen cannot be extracted and consumed with minimal processing—it requires a manufacturing process.

Additionally, most hydrogen fuel cells use a platinum catalyst, which further drives up the technology’s cost. Research on nickel or iron catalysts, among other materials, is ongoing. The hydrogen bikes themselves are also expensive in comparison to conventional battery-powered e-bikes.

Market readiness

Even if these other challenges are overcome by innovation, market readiness is difficult to induce. Individual hydrogen bikes for household use remain prohibitively expensive, which keeps demand low and reduces the incentive for further innovation.

Currently, hydrogen bikes seem best suited for niche applications. For example, they could be used in delivery fleets or shared mobility programs (think Citi Bike, Indego, Capital Bike Share, or Divvy) where centralized refueling infrastructure can be more easily managed.

Slope of Enlightenment: The outlook for hydrogen bikes

Adoption of hydrogen power for many types of transport should not be as much of an uphill climb as it is. If hydrogen is produced by renewable energy from electrolysis, it generates no harmful byproducts. Yet significant challenges to green hydrogen production, transport, and storage remain—with efficiency losses at each step.

Given these challenges, what would be required to start the peloton up the slope? Household-scale domestic hydrogen production from renewable sources would reduce efficiency losses and has been demonstrated as achievable. Hydrogen is already making inroads as a fuel for buses, heavy trucks, and trains, where battery limitations are more of an issue.

Hydrogen bikes may become more common as a complement to, rather than a complete replacement for, battery-powered e-bikes. Their presence in the market offers diversity and resilience to the e-mobility ecosystem. However, it remains to be seen if these hype cycles will ever make the triumphal ride through the Plateau of Productivity and claim a yellow jersey of their own.

Author

Becky Stewart

CTT Categories

- Market Insights

- Transportation