Chinese bidders apparently see more value in A123 Systems than the leading United States suitor, and, according to an article in the New York Times and in reports in other business news outlets, will probably walk away with most of the lithium battery maker. The paper reports that Wanxiang Group‘s offer of $256 million for A123’s three manufacturing facilities and its commercial businesses top what Johnson Controls felt the company is worth.

Interestingly, while it appeared until now that Wanxiang and Johnson Controls were going to be the only ones to enter the bankruptcy auction, the Times reports that a Japanese company, NEC Corp., and a German company, Siemens AG, also submitted bids.

One significant asterisk to the deal is that the portion of A123’s business related to government/military work has been carved out and will be sold to Navitas Systems, a company based in Woodridge, Ill., for $2.2 million. Navitas implies that it is already involved in the production of lithium batteries and energy systems for military applications, but it seems relatively new (and its web page has only been online for a few months). Most of the people involved with Navitas used to be involved with an entity known as MicroSun Technologies, which was recently sold to Palladium Energy.

The carve out is necessitated by concerns raised about the loss of certain intellectual property and “sensitive military technology” to non-US firms. In late November, a nongovernmental policy group, the Strategic Materials Advisory Council, publicly raised objections to the sale of A123 to Wanxiang. The SMAC’s website describes itself as “a coalition of former US government leaders and industry experts who have significant experience with strategic and critical materials” and says the group “was formed with the clear objective to promote policy solutions that ensure continued access of both US industry and military to those materials needed to support a robust 21st century economy and military.” SMAC urged Treasury Secretary Timothy Geithner to block a sale to Wanxiang. Even with the proposed Navitas carve out, SMAC is unhappy and today called upon members of the Treasury Department’s Committee on Foreign Investment in the United States to block the deal. The CFIUS must approve the bankruptcy agreement (as must the Delaware Bankruptcy Court judge assigned to oversee A123’s future) it’s not clear to me if anyone has mustered the financial, legal and political arguments to derail things.

Wanxiang, which has a US affiliate and apparently employs several thousand here, it is still committed to following through on production agreements with GM and Fisker Automotive.

Johnson Controls officially withdrew itself from the bankruptcy auction Dec. 9, noting that it “declined to match a higher bid.” Alex Molinaroli, president, Johnson Controls Power Solutions, says, “While A123’s automotive and government assets were complementary to Johnson Controls’ portfolio and aligned with our long-term goals, Wanxiang’s offer was beyond the value of those assets to Johnson Controls.”

It isn’t surprising that companies in these situations value the same property differently. Typically, bidding companies try to estimate the value of physical and intellectual assets, and then add the net value of future revenues. In particular, valuing future revenue flows can vary greatly from company to company, based on the possible “fit” of the acquired business, assessment of risks, proprietary market insights, etc.

Meanwhile, Reuters reports that A123 will not get the remaining $116 million that was the balance of a $249 million DOE grant. Reuters says bidders for the company were aware that grant payouts were to end.

CTT Categories

- Energy

- Market Insights

Related Posts

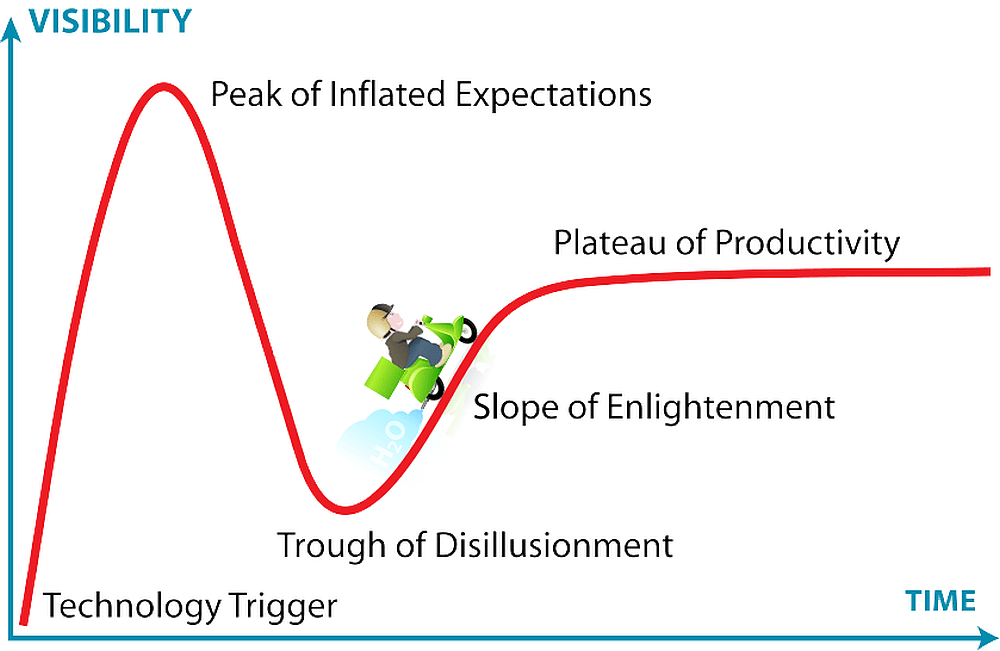

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025