(h/t to GlobalSpec) Not unpredictably, Japan’s ongoing nuclear problems are going to reshape how nations allocate their future energy investments, and a new report from McIlvaine Company estimates that $200 billion will be retargeted to fossil and renewable energies.

McIlvaine, a market research company, says China and India, in particular, are likely to increase their reliance on coal, although this shift will be transitional. The company’s website says, “Despite the recent advances in extracting gas from unconventional sources such as shale, there will not be a massive shift to gas-fired power. The reason is that gas can be converted into liquid products. Any big disparity between the price of oil and gas will eventually be eliminated by building gas-to-liquid plants. Since the price of oil is predicted to increase, gas will follow suit and be too expensive to be the main power plant fuel. A new perspective is being formed relative to coal. Since the economic life of a coal-fired power plant is as short as 25 years, investment in new coal-fired power plants is now being viewed as a bridge to a post 2040 policy with lower reliance on fossil fuels and more on renewable.”

Regarding renewables, the company says that the beneficiaries will be wind power (+$40 billion) and solar (+$20 billion).

CTT Categories

- Energy

- Market Insights

Related Posts

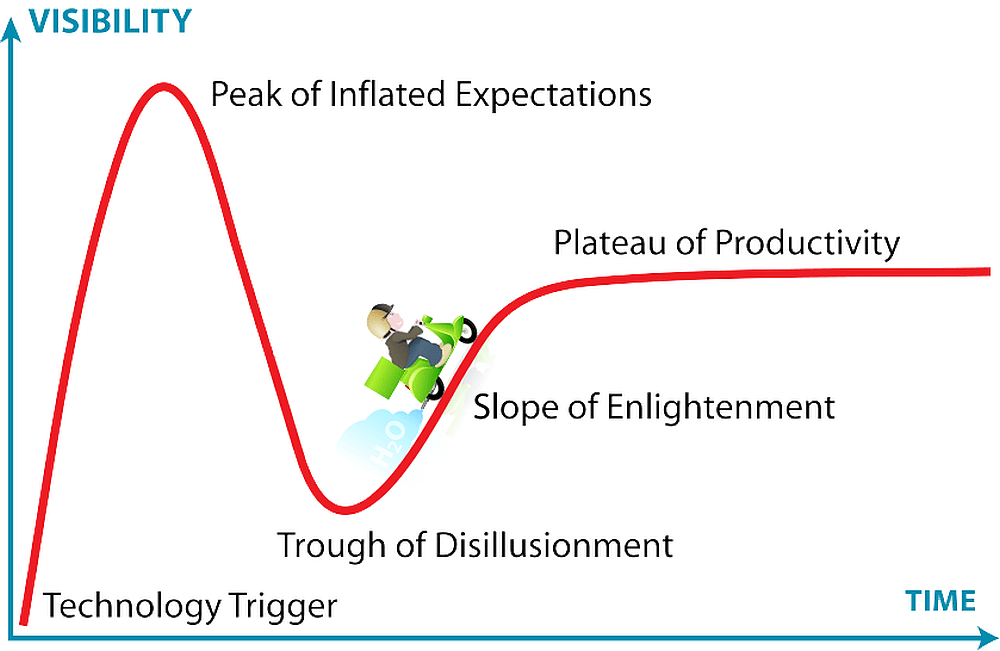

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025