German Chancellor Angela Merkel and Chinese Premier Wen Jiabao discussed rare earth supplies in their Feb. 2, 2012 meeting.

There have been long-standing and well-known strains between China and much of the rest of the world over rare earth supplies, but projections for 2012 look like access to the materials won’t be an immediate concern because demand is less than expected. It is hoped that this provides valuable breathing space for other nations and regions to flesh-out their strategic plans (rather than being lulled into believing a crisis has passed) related to critical materials.

Bloomberg News Service earlier this week ran a story about this (with a misleading headline, “China may double rare earth exports as demand rebounds”) about how the external market demand for China’s exports ran below the quotas set for 2011. To be clear, what Bloomberg means is not that China is doubling its export limits. On the contrary, the export quotas for 2012 apparently will be about the same as for 2011, but demand is expected to more closely match the quota maximum.

To put an even finer point on this, according to a recent document on the website of China’s Ministry of Commerce, “China’s rare earth exports totaled 14,750 tons in the first 11 months of 2011, accounting for 49 percent of total export quotas. Large quantity of most export quotas still lay idle. Even though, confronted with huge pressure of resource, environment and domestic demand, in order to guarantee international market demand and keep rare earth supplies basically stable, export quota of 2012 are equal to that of 2011.” In other words, the open demand for Chinese rare earth products shifted in 2011 from being greater than quota amounts to less than half of the quota.

What caused the shift? Of course, the economic problems of North America, Europe, Japan and many other regions were a huge factor. Bloomberg reports that another factor is that the growing prices for some rare earths made consuming businesses decide to tap and deplete their existing inventories before placing new orders.

At least two other factors are also at work. One is that buyers apparently are still finding ways to purchase rare earths through less-than-legal Chinese channels. Second, the higher prices provide an incentive for non-Chinese producers to dig and refine their reserves, so other minor supply streams are at work.

Meanwhile, trade dispute and diplomatic efforts are still being used to reach longer-term solutions. For example, the topic of rare earth supplies came up in a meeting in early February between Chinese Premier Wen Jiabao and German Chancellor Angela Merkel. Wen reportedly told Merkel, “Although we now know that we must develop rare earth metals sustainably, we can still afford to meet 90 percent of global demand with less than 50 percent of the world’s reserves.”

CTT Categories

- Energy

- Market Insights

Related Posts

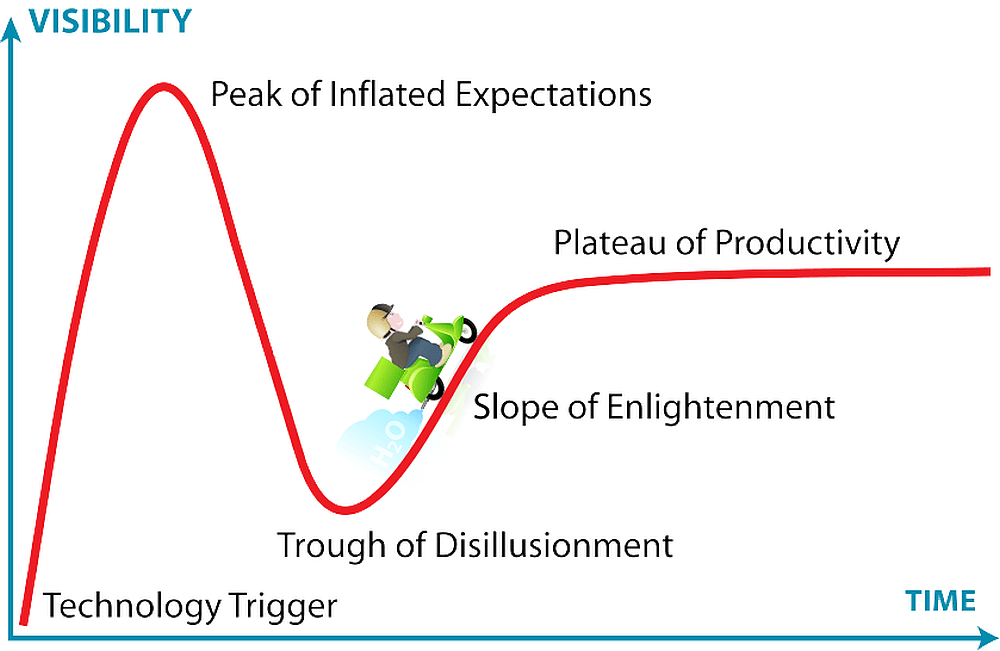

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025