E-bikes are growing in popularity in China’s urban areas, and many other countries.

In contrast to DOE’s continuing efforts to accelerate the use of plug-in hybrid electric vehicles, Lux Research still predicts that small-battery applications will power innovation, at least globally, in regard to electricity-enabled vehicles.

We noted last year that Lux believes much of the recent growth in electric vehicles technology and business has been and will continue to be related to transportation scales considerably smaller than PHEV’s, such as battery-assisted e-bikes. Likewise, when a company representative spoke at ACerS’ 2010 Ceramic Leadership Summit, she chided participants for 1) not seeing the link between e-bikes and battery innovation, particularly with lithium-ion technology; 2) not seeing the global market for microhybrid vehicles; and 3) not seeing opportunities for advanced lead-acid batteries.

A new report from Lux, which the company describes as “a reality check on the hype surrounding batteries for electric passenger cars,” continues to beat that same drum. According to this report, the company is generally upbeat about electric vehicles, predicting that the total market for related energy storage technologies will grow from $13 billion in 2011 to $30 billion in 2016. That’s the equivalent of a compound annual growth rate of 18%.

In a release from Lux, report author Kevin See seems to suggest that the DOE’s push on PHEVs may be too narrow. “Although battery prices for all-electric and hybrid passenger cars are dropping, they’re not dropping far enough or quickly enough to fuel the sort of broad adoption that advocates expect,” says See. “Instead, the substantial growth we see for vehicle-related storage technologies will be powered mostly by e-bikes — which are shifting from lead-acid to Li-ion battery technology — and microhybrids, which offer a more incremental, low-risk way for automakers to improve fuel efficiencies.”

See asserts that the market for microhybrids, more popular overseas, is easier to jump-start and grow because it requires “neither the drastic redesigns nor the more expensive battery costs that all-electric or hybrid electric vehicles do.”

In regard to e-bikes, popular in Asia (120 million in China in 2010), See compares the battery size-factors: e-bikes require 0.4—1.0 kWh while a Nissan Leaf needs a 24-kWh battery pack. He says that because of new growth and the emerging demand for replacement batteries (Li-ion and lead-acid), the market will grow from $12.0 billion this year to $24.3 billion in 2016.

Even more boldly, See argues that, “Advanced lead-acid batteries [will] dominate the current and future storage market. While Li-ion technology will eat into lead-acid sales for e-bikes, and supercapacitors will steal share in microhybrids, lead-acid will maintain a comfortable lead in both of these high-volume and growing markets.” He says the lead-acid market will grow from the current annual sales of $9.4 billion to $16.1 billion in 2016.

CTT Categories

- Energy

- Market Insights

- Transportation

Related Posts

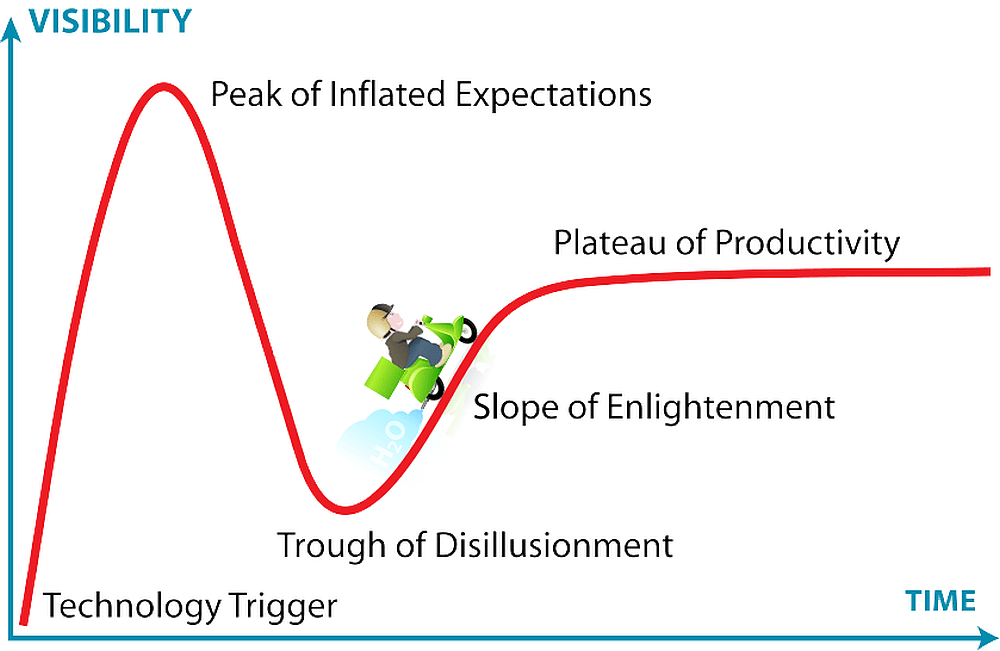

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025