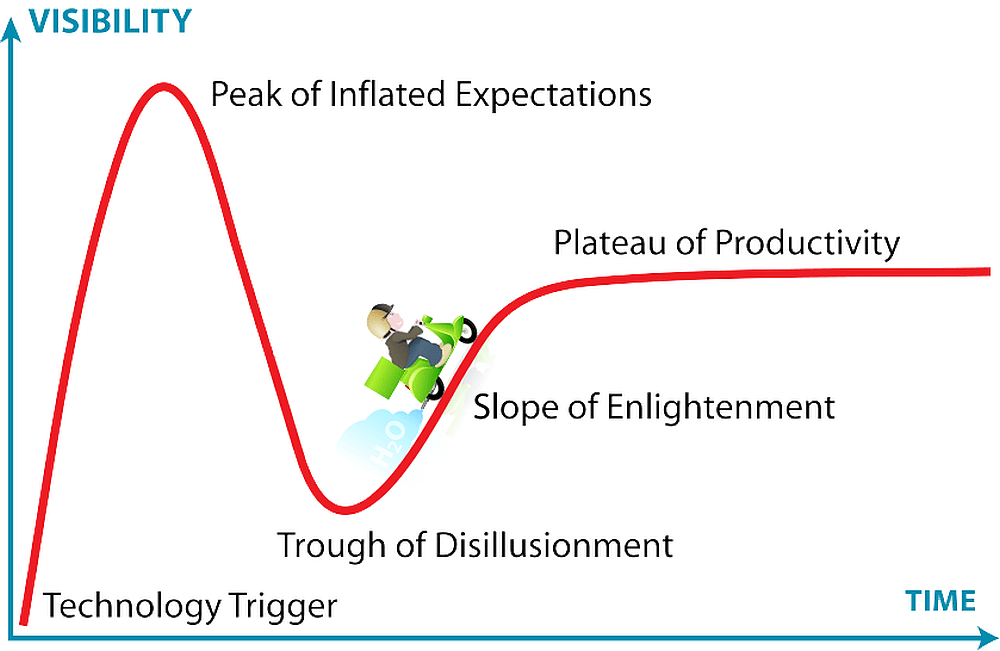

Maybe not a zugzwang yet, but rare-earth strategies are getting more complex and riskier.

It’s been a while since I have addressed strategic materials, but several recent developments are worth noting.

Let’s start by going back a few months. In late March, a ripple went out among rare-earth supply watchers when China’s Ministry of Finance and State Administration for Taxation announced a new tax on exports of strategic raw materials.

The size of the ripple depended on whether you were an optimist or a pessimist. The optimists saw the tax as no big deal — just about $5–10 per metric ton — given that some RE prices-per-ton are in the tens of thousands of dollars. The pessimists saw the new tax as a subtle and further indication that RE exports would be curtailed even more than they already have been in recent years.

At that time, the Xinhua New Agency reported that the tax monies would be used “to support research on rare-earth processing and application technology, set up environmental compensation funds or build rare earth reserves” [emphasis added].

Yesterday, Xinhua reported that “authorities from a variety of mining-related companies and groups convened at a high-level meeting on Monday and Tuesday to discuss environmental protection, industrial consolidation and the regulation of rare earth mining and exports,” i.e, the same topics raised when the new tax was announced. The news agency’s report indicated that China’s State Council (analogous to a presidential cabinet) wanted the meeting to nail down implementation of a guideline issued by the Council in May “to promote the healthy development of the rare earth mining industry.”

By “healthy development,” China appears to mean a couple of things. The first is that the nation is going to crack down on small semi-legal mining operations, which have been linked to smuggling and environmental and worker accidents. Second, China is going to consolidate RE production and responsibilities and distill these into a handful of state enterprises in specially designated mining regions. The third is to stop unregulated or underregulated exports of REs in alloys.

Finally, and perhaps most interestingly, Xinhua offhandedly buries what is actually the lead to this story for those of us outsider the country: China nation intends to build a national strategic stockpile system for REs. This is the first, to my knowledge, that a Chinese national stockpile has been directly discussed, although it has been inferred in many official statements.

Later, yesterday, the Wall Street Journal/Dow Jones news service sheds more light this RE strategic stockpile, based on information it attributes to “people with direct knowledge of the plan.” Although the exact plan still waits for final approval, it likely would result even fewer RE exports and high global prices.

The WSJ/DJ story reports that the plan “would follow an approval in 2009 to build strategic reserves of light rare earths in China’s Inner Mongolian Autonomous Region. That plan is supposed to be undertaken by Inner Mongolia Baotou Steel Rare-Earth (Group) Hi-Tech Co., the country’s largest rare-earth producer by output … The stockpiling of heavy rare earths would be led by big state-owned companies and implemented on a national basis, generally repeating the formula used for the light rare-earth reserves, the people said. China is considering a plan to allocate a large amount of capital to subsidize companies that store up heavy rare earth resources, one of the people said. He didn’t specify the exact amount.”

The struggle over strategic materials is always a cat-and-mouse game, where cause and effect are hard to differentiate, but I doubt it was just coincidence that a few months ago a significant player in U.S. politics, Colorado Congressman Mike Coffman, again pressed for the U.S. to create its own national stockpile and establish a “Defense Logistics Agency” that would enter into long-term supply contracts and then make the supplies available for purchase to federal government contractors. Coffman, a member of the House Armed Services Committee, says the effect of a bill he has proposed would be “to generate a domestic market and facilitate the domestic sourcing of rare earth alloys and magnets.”

Some members of the science and engineering community in the U.S. think Coffman’s proposal is wrongheaded and may stifle innovation. In February, the American Physical Society and Materials Research Society issued recommendations that warns against reliance on a RE stockpiling strategy and instead suggests “an integrated approach to securing supplies of these key materials.” The APS/MRS proposals include more systematic and centralized information gathering about RE sourcing, applications and life cycles; investments in R&D for substitutes and recycling; and use of marketplace economic forces.

It’s hard not to feel like there is much more going on in diplomatic and intelligence circles than ever reaches outlets for public consumption, but scarcities of REs and other strategic materials are clearly on the minds of a lot of businesses and researchers. Unfortunately, it doesn’t come up for discussion as much as it should (in my opinion) in technical meetings. However, it is appropriate for me here to put in a plug for ACerS’s Ceramics Leadership Summit, which plans to have some frank discussion about critical and strategic materials.

In its second year, CLS is designed to be a nontechnical, frank and unbiased forum for economic, business, government and academic leaders to share perspectives, identify critical needs and roadblocks, discuss collaborations, etc. Raw materials scarcity is key topic that last year’s participants asked to be prioritized in the 2011 CLS program. I expect many of the plenary speakers will address this topic in one way or another, but two particular back-to-back CLS presentations will be directly on this topic. The first will be by Mark Patterson, Director of Engineering Research Initiatives at the University of Arizona, on “Raw Material Trends Impacting the Ceramics and Glass Community. The second is by Michael Hill, R&D Technical Director at Trans-Tech Inc., on “Raw Material Scarcity and its Impact on the U.S. Advanced Ceramic Development (An Industrial Perspective).” Given that Patterson and Hill approach this problems from very different perspectives (academic versus business), I am eager to see where they find common ground in regard to supply chains, government initiatives, sustainability, etc. The CLS takes place Aug. 1-3, 2011, in Baltimore, Md.

… adding, maybe everybody didn’t get the word or agree with the new guidelines.

CTT Categories

- Basic Science

- Electronics

- Energy

- Glass

- Manufacturing

- Market Insights

- Optics