[Image above] Red may become the new “white” for ceramic tiles if Ukraine remains unable to export its high-quality clay. Credit: David von Diemar, Unsplash

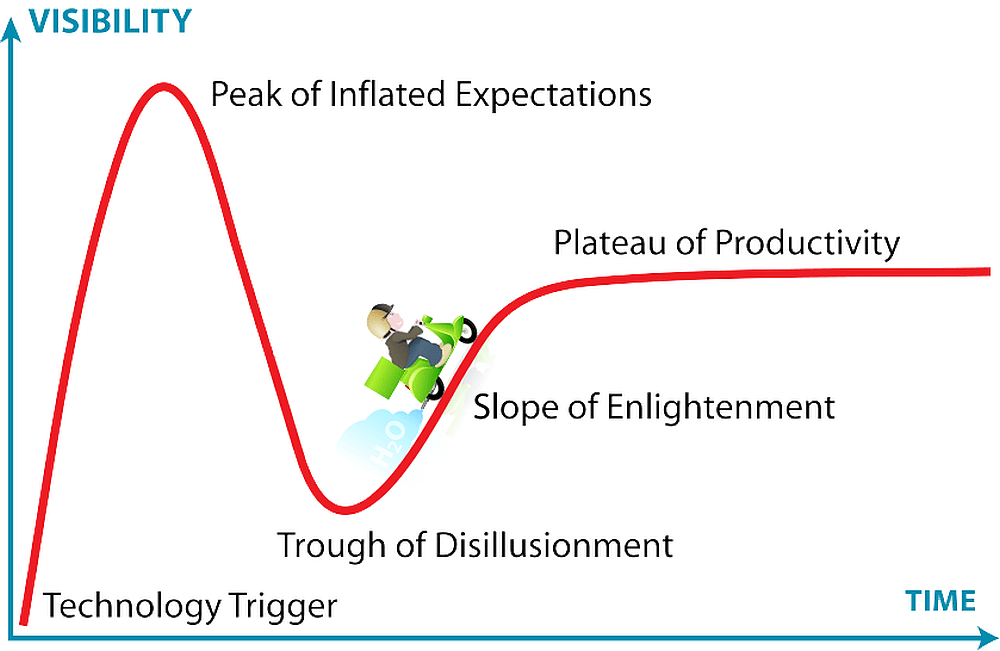

More than two years have passed since Russia launched its full-scale invasion of Ukraine, and as the conflict has settled into a war of attrition, the global ramifications of this situation no longer grip headlines like they did at the start. But industries that rely on Ukrainian commodities continue to feel the effects of the war’s disruption on major supply chains, such as clay.

Clay is critical to the production of ceramic tiles (decorative and flooring) and refractory ceramics, both substantial global markets. Clay minerals are also used in products ranging from paper, paints, and coatings to polymer composites, cosmetics, and pharmaceuticals.

Since the 1990s, Ukrainian clay gained a reputation around the world for its purity and good consistency. There are currently around 40 recognized refractory and ball clay deposits in Ukraine amounting to more than 600 million tonnes in resources, with most deposits concentrated in the Donbas region, near Donetsk, eastern Ukraine, according to an IMFORMED article.

When Russia invaded Ukraine and the country could no longer export its clay, tile manufacturers rushed to find alternative sources of clay. But as explained in a May 2022 CTT, finding new sources was extremely challenging given the special qualities of Ukrainian clay, which led to shortages of very white and large-format tiles.

With sky-high demand for high-quality clay, some manufacturers are considering reformulating their tiles based on clay in local deposits. Though the tiles produced from domestic sources may not be pristine white, “Expanding the available sources of raw materials is essential to mitigate the supply risk,” researchers write in a recent paper.

The researchers come from the University of Modena and Reggio Emilia and the Institute of Science, Technology, and Sustainability for the Development of Ceramic Materials in Italy. In the paper, they conduct a comprehensive characterization of two Italian clays to determine their suitability for porcelain stoneware production.

The clays come from quarries located near the town of Sassuolo, which lies at the heart of the Italian ceramic industry. The clays here are iron-rich (∼7% Fe2O3), which can lead to well-known issues in ceramic tile production, such as warping and bloating during firing.

The researchers used wavelength-dispersive X-ray fluorescence spectrometry to reveal the clays’ mineralogical composition. They then used methods such as thermogravimetric and thermo-differential analyses to fully characterize the clays during each step of tile production, from milling to firing.

They compared the results to those from a conventional iron-rich (∼3% Fe2O3) German red clay. For context, the most widespread and commercially available iron-rich ball clays come from Westerwald, Germany, which is the second largest supplier of clays for the Italian ceramic tile industry. The researchers explain that this comparison “will help in distinguishing between the effect due to the presence of iron and to the different mineralogical compositions.”

The mineralogical characterization revealed that the Italian clays did not contain any organic matter and had only a low amount of sulfur. These findings are “particularly important” because organic matter can cause undesired effects in tiles properties, such as color changes, reduced mechanical strength, and increased fire loss, while the presence of sulfides can lead to unwanted gas emission during firing, the researchers explain.

The data collected during tile production showed that partially substituting the iron-rich Italian and German clays for classic ball clays in porcelain stoneware did not cause severe technological bottlenecks, though it did affect the process. The grindability worsened when using 20–35% of the low-plasticity German clay, while the rheological behavior of the slip worsened when using 10–20% of the highly plastic Italian clays.

“Both drawbacks can be easily overcome by increasing the milling time and the amount of deflocculant, respectively,” the researchers write.

Using iron-rich clays noticeably affected the firing behavior, however. The German clay required an increase of the sintering temperature, while the Italian clays required a reduction of the firing temperature. The researchers note that “a study of the role of iron in the vitrification path and sintering kinetics is necessary” to fully understand why the clays had this effect.

While all previously described effects can be accounted for by modifying the processing parameters, the effect that cannot be easily overcome is the change in color. The iron-rich clays resulted in darker and reddish tiles, in contrast to the bright white tiles that are produced using Ukrainian clay.

But with the current constraints on the supply chain, it is likely that red will need to “become the new ‘white’,” says Brendan Clifford, co-CEO of Portugal-based Mota Ceramic Solutions, in the IMFORMED article.

The paper, published in Applied Clay Science, is “Reappraisal of red clays in porcelain stoneware production: Compositional and technological characterization” (DOI: 10.1016/j.clay.2024.107291).

Author

Lisa McDonald

CTT Categories

- Manufacturing

- Market Insights