Calisolar silicon is purified in a unique, liquid-phase process producing solar silicon without the high energy and specialized equipment of conventional vapor-phase silicon purification.

As I have written several times before, the costs tied to the processing and manufacturing of photovoltaic units are dropping, but they are still the main impediment to PV being price competitive with coal-generated power. Thus, it is wise for the DOE to leverage some of its financial power to help 1366 Technologies Inc. and Calisolar Inc., two companies focused on slimming down a major part of the PV value chain: making the silicon that forms the crucial performance foundation of PV units. On Thursday, the agency announced a $275 million loan guarantee for Calisolar and Friday it announced a similar deal for 1366 for $150 million.

Keep in mind that these are loan guarantees, not direct grants. Both companies have received funding from parts of DOE in the past, but these loan guarantees are extremely important to the enterprises’ business models by lowering the cost of capital investments (with DOE assuming nearly all of the financial risk).

1366’s direct wafer technology, in a nutshell, eliminates the waste that occurs in slicing expensive silicon ingots into wafers and, in doing so, also eliminates several steps in the traditional wafer production process. 1366/MIT guru Emanuel Sachs is well known for postulating that “manufacturing innovations in silicon PV will decrease costs by 10% per year through 2020, at which point solar electricity becomes cheaper than coal” (Sachs’ Law). 1366 has also developed novel approaches to other PV production steps and performance enhancers, such as busbar improvements.

The DOE predicts that with its next round of funding, 1366 will be capable of producing approximately 700 to 1,000 megawatts worth of wafers annually and reduce wafer costs by about 50 percent. The company has a two-phase plane, with the first and smaller phase involving construction of a facility in Lexington, Mass. DOE says that plant will yield 70 permanent jobs. The second phase “will create hundreds of additional jobs.”

The Calisolar deal is supposed to be a bigger deal, at least, as far as job-creation goes, with 1,100 permanet jobs planned for a converted auto parts stamping plant near Mansfield, Ohio, that, as a story in the Columbus Dispatch notes, has been desperate for new manufacturers since GM departed.

Calisolar, including a company it has acquired, 6N Silicon, has been on DOE’s radar for several years. 6N was begun by Scott Nichol and is rooted in work done at Cananda’s McMaster University where he developed a method to reduce silicon costs by perfecting a relatively inexpensive way to purify cheap, low-grade silicon. As the story goes, the 6N name refers to “six nines” or 99.9999 percent purity.

Calisolar, meanwhile, had been developing low costs methods related to the conversion of solar silicon to production wafer, including crystallization, wafering and cell processing. The company was launched in 2006 by veteran materials engineers Kamel Ounadjela, Fritz Kirstch and Eicke Weber.

When Calisolar and 6N joined forces in 2010, it gave the company a way to control and vertically integrate four key productions steps. It’s not clear what total value chain savings they can generate, but they claim silicon costs are reduced 50 percent, and the company’s capital and construction investments are only one-sixth that of a traditional polysilicon cell maker.

According to DOE, “the manufacturing plant is expected to produce 16,000 metric tons of solar silicon annually, equivalent to more than two gigawatts of solar power generation per year. The project will be built in three phases of 5,333 MT capacity each.”

CTT Categories

- Energy

- Manufacturing

- Market Insights

Related Posts

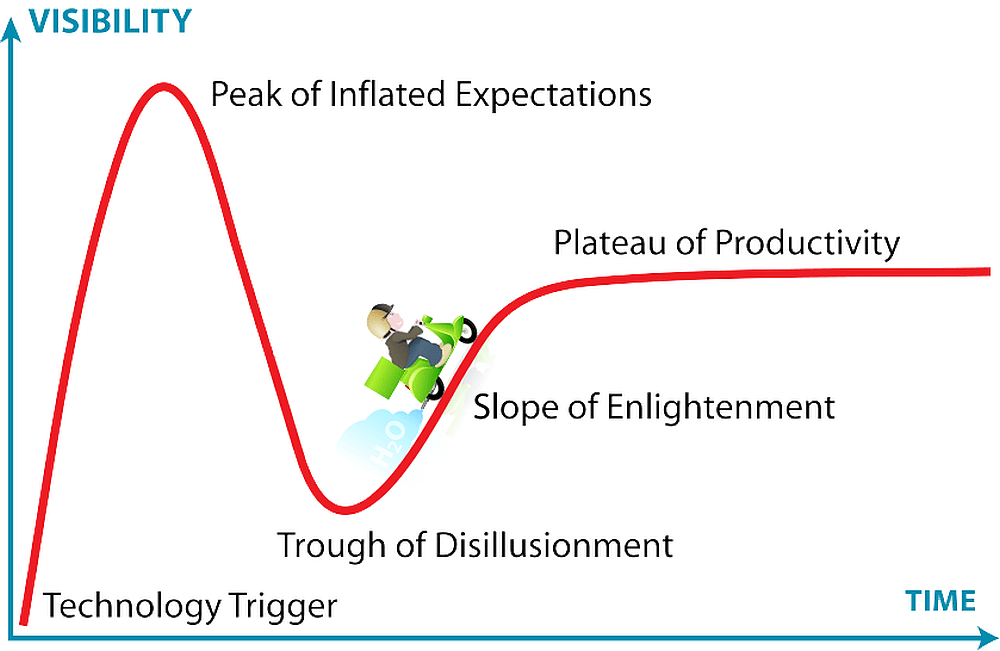

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025