Not unexpectedly, the Solyndra investigation threatens to be poisoned by the unfolding political theatrics. Although I am as curious as the next guy to find out what, if anything, happened behind the scenes related to internal analyses of Solyndra’s finances, business model and technical advantages, I never had any illusions that congressional hearings in the midst of investigations by the FBI and inspectors from Treasury and DOE would be productive.

The decision by the CEO and CFO to opt out of a House Energy and Commerce Committee hearing was guaranteed the moment the folks with the no-kidding badges arrived at the company’s front door, so all that is left for Congress to do right now in regard to Solyndra’s management is the theatrics. On with the show!

From Bloomberg:

“Mr. Harrison intends to invoke his Fifth Amendment rights in response to any questions asked by this subcommittee and will not provide testimony,” Walter Brown, a lawyer at Orrick, Herrington & Sutcliffe LLP in San Francisco representing Harrison, wrote today to the investigations panel.

“The company is not aware of any wrongdoing by Solyndra officers, directors or employees” related to the Energy Department loan guarantees or other actions “and the company is cooperating fully” with the U.S. Attorney in San Francisco, Miller said in a statement.

“The record will establish that Solyndra carefully followed the rules of the competitive application process, starting in December 2006 under the Bush administration and continuing under the Obama administration,” he said.

With one exception, I don’t have anything to add to what Eric Wesoff says over at GreenTechSolar:

Optimism and denial by the company? Yes. Poor due diligence by the VCs and the DOE? Absolutely. Criminal activity? Not at this point in the company’s timeline, at least. No smoking gun email with political motives will be found because none likely exists. Save the desire to get a factory built, money deployed, and jobs created. Maybe a few corners cut to get to that objective at the DOE.

The problems start to occur when the IPO is suspended, the reality of cost targets become clear, and a new CEO is put in place.

Brian Harrison, the new CEO, is installed at the helm of this Titanic at a salary of more than $400,000, and not to defend him, but he’s inserted into an untenable position. No management skills or manufacturing process skills could alter the course of this company.

Harrison looked me in the eye at a recent interview and told me to my face that the firm would not need to take any additional funding. He was either in denial or being disingenuous.

The more solar modules the company shipped, the more the company lost and the faster the money was running out. The CEO and the CFO had to know this.

Somewhere in a file, wastebasket, or hard disk drive is the evidence that the FBI is seeking – that the officers of the company knew, as their auditors declared a year ago, that they were not a “going concern,” and that the hammer was going to come down hard and soon.

That they failed to notify their investors and the DOE in a honest fashion is the issue here. Is it corporate malfeasance and negligence? Without a doubt. Is it a crime? We’ll soon find out.

Repeating myself, my additional point is that there needs to be a specific explanation of the subsequent renegotiation of Solyndra’s loan guarantee that put a piece of the fed’s money at greater risk than in the original agreement. Much of the “official” reporting has been sloppy on this point (and the general benefits of having a federal loan guarantee program), especially in niche fields where capital markets aren’t very efficient, and the concept of loan guarantees versus loans. The Columbia Journalism Review also has a dim view of the quality of some of the business reporting.

Reader EDW also suggests some valuable perspective on Solyndra versus other situations:

Solyndra investment compared to what the Times calls the Pentagon’s “biggest boondoggles”

Solyndra’s loan guarantee was 3.4% of the DOE solar portfolio

And, in the “do as I say, not as I do” category, Thursday Darrell Issa, chairman of the House Oversight and Government Reform Committee, is holding a hearing that Bloomberg says is titled, ““How Obama’s Green-Energy Agenda is Killing Jobs.” Bloomberg notes that while Issa recent questioned in a C-SPAN interview whether “government can weigh-in with loan guarantees and money and pick specific winners and losers,” he asked for DOE to provide financial assistance to two California companies (Aptera and Quallion)

And, last but not least, Jon Stewart’s riff on Solyndra:

CTT Categories

- Energy

- Market Insights

Related Posts

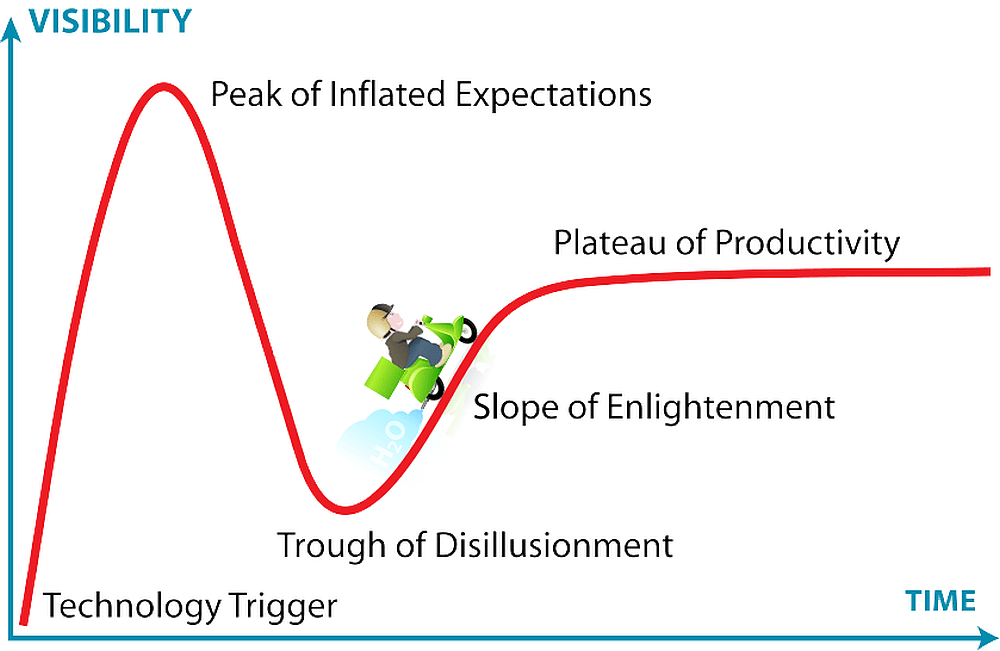

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025