It still seems like the Solyndra thing is going to stay messy and politicized. From Bloomberg:

Republicans on the House Energy and Commerce Committee released the findings of a seven-month investigation into U.S. support for Fremont, California-based Solyndra today before a hearing where two administration officials faced questions about White House support for the company and its goals for clean energy.

The Department of Energy and the Office of Management and Budget “did not take adequate steps to protect taxpayer dollars,” according to the report.

…

Earlier in the approval process for Solyndra, in an e-mail on March 10, 2009, an official at OMB wrote a colleague, “This deal is NOT ready for prime time.”

And an AP story reports;

“We would prefer to have sufficient time to do our due diligence reviews and have the approval set the date for the announcement rather than the other way around,” said one of the emails from an unnamed OMB aide to the office of Vice President Joe Biden.

Again, I make full disclosure that I could be counted among the cheerleaders for Solyndra.

If I had to make a prediction on where this is heading, it looks to me like the real problem isn’t the initial loan guarantee, but the later renegotiation of the terms that subordinated some of the federal debt. But, hey, obviously, what the heck do I know?

[Update 9/16/11] Several new developments:

• Several news outlets are reporting that the Treasury Department’s inspector general has opened an investigation into the role and actions of the Federal Financing Bank, a government corporation supervised by the Treasury Department.

• A new story out today from the AP adds more about Solyndra, but also hints at red flags around some other loan applications and recipients:

In July 2010, the Government Accountability Office said the Energy Department had bypassed required steps for funding awards to five of 10 applicants that received conditional loan guarantees.

The report did not publicly identify the companies that were not properly vetted, but congressional investigators say one of them was Solyndra.

In March, DOE Inspector General Gregory Friedman again faulted the loan program for poor record keeping, finding that the department kept limited or no electronic data on 15 of 18 loan guarantees examined.

…

A report last year by auditor PricewaterhouseCoopers said Solyndra had suffered recurring losses from operations and negative cash flows, raising “substantial doubt about its ability to continue as a going concern.”

The phrase, “doubt about its ability to continue as a going concern” is a term-of-art used by auditors and MBA-types to formally note that an entity will soon be insolvent unless there is a drastic change.

• Finally, I hadn’t seen this reported earlier, but this is from ABC:

Earlier this month, iWatch News and ABC News disclosed that Solyndra received a rock-bottom interest rate of 1 to 2 percent — lower than those affixed to other Energy Department green energy projects. The low rate was set even as an outside agency, Fitch Rating, scored Solyndra as a B+ — “speculative” — investment. Energy Department officials said the bank set the rate, based on formulas including the payout length, and that Solyndra did not receive special treatment.

That begs the question, when DOE says “the bank set the rate,” is that a reference to Treasury’s Federal Financing Bank?

CTT Categories

- Energy

- Market Insights

Related Posts

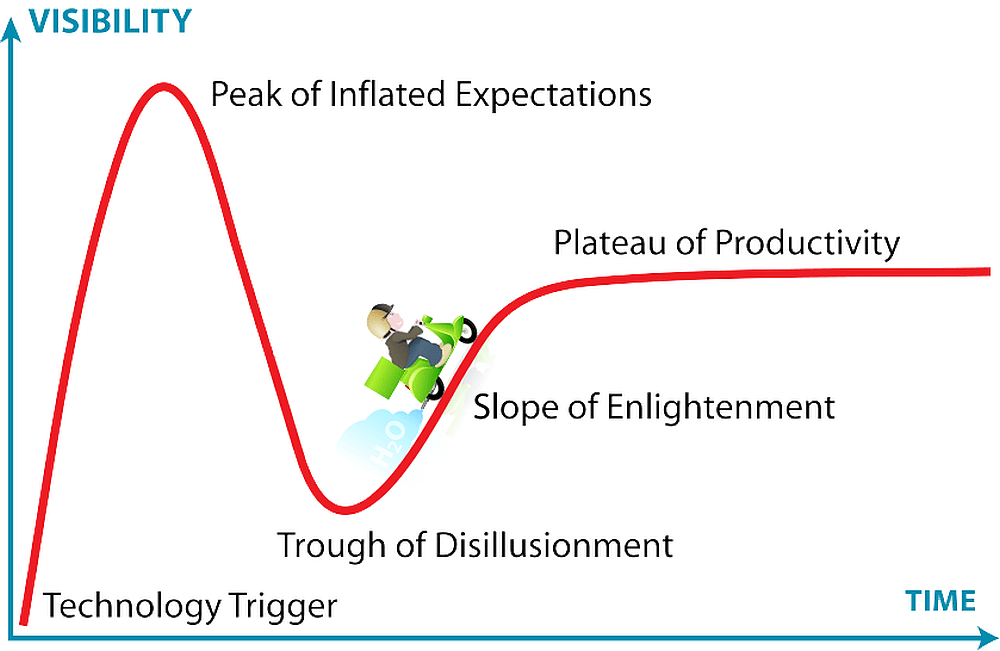

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025