This was the bad news (at least for investors) from Fremont, Calif., last week:

Solyndra LLC, the American manufacturer of innovative cylindrical solar systems for commercial rooftops today announced that global economic and solar industry market conditions have forced the Company to suspend its manufacturing operations. Solyndra intends to file a petition for relief under Chapter 11 of the U.S. Bankruptcy Code while it evaluates options, including a sale of the business and licensing of its advanced CIGS technology and manufacturing expertise. As a result of the suspension of operations, approximately 1,100 full-time and temporary employees are being laid off effective immediately.

I first wrote about Solyndra nearly three years ago, and I was impressed with its wedding of CIGS (copper indium gallium diselenide) technology with tubular 360° design to easy flat-panel installation. Each unit was lightweight and said to be more tolerant of environmental conditions, such as wind. These aspects coupled with Solyndra’s high-automation assembly line (which, admittedly, carried a hefty capex risk) seemed like it would make it at least a contender, if not a leader in the commercial PV markets.

I was not alone in being impressed with the company. A number of venture capital groups (e.g., Rockport Capital Partners and Madrone Capital Partners) and, apparently, even a nonprofit (George Kaiser Family Foundation) invested in Solyndra, and about several hundreds of millions was raised from private sources. The most high profile bettor on the company, however, was the DOE, which offered in mid-2009 a $535 million loan guarantee to assist the company build a larger and even more automated fabrication facility. Planning for the offer began under the Bush administration

The new facility was opened a year ago and eventually employed 1,000+. Revenues in 2009 were $100 million and climbed to $140 million in 2010. But by November 2010, some cutbacks and layoffs were announced.

What happened next is a little sketchy, but it seems that the DOE, now under the Obama administration decided to renew its bet early in 2011. According to reporting by William McQuillen at Bloomberg, additional private money could be available to Solyndra, but only if this private debt was made more senior (i.e., gets repaid ahead of) a chunk of the DOE monies.

McQuillen writes, “[DOE] decided the January refinancing represented the “highest probable net benefit” for the government, according to a government document obtained by Bloomberg News. Investors provided the company $75 million that became senior debt, ahead of all but $150 million of the federal government’s stake.”

In other words, the $385 million of the loan guarantee would be subordinate if the company failed. And, well … that is what happened. To be sure, some of that might be recouped if bankruptcy negotiations fail and the only outcome is liquidating the company’s assets.

The liquidation value must have been part of how the DOE came up with the $385 figure, but not entirely. Interestingly, the Bloomberg story also reports that Solyndra also gave the DOE intellectual property rights as part of its collateral.

Besides potential governmental losses, a slew of Solyndra’s workers were suddenly laid off, and the swiftness of these layoffs suggests either some mismanagement or, quite possibly, that there was some hope for a white knight rescue right up until Aug. 31.

This summer was brutal for US photovoltaic companies. Solyndra joined Evergreen Solar and SpectraWatt in filing bankruptcy.

Solyndra blames its problems on “global oversupply of solar panels and a severe compression of prices that in part resulted from uncertainty in governmental incentive programs in Europe and the decline in credit markets that finance solar systems.”

One of Solyndra’s competitors in the PV market takes exception with that. Barry Cinnamon, Westinghouse’s CEO, notes that some of the competitive advantages Solyndra was banking on didn’t pan out. One, for example is that Solyndra believed that silicon would remain expensive and its CIGS-based technology would provide a cost advantage. Says Cinnamon, “Unfortunately for Solyndra, and fortunately for all the silicon solar panel manufacturers and customers, silicon has gotten very cheap over the past few years. So, the problem that Solyndra solved—expensive silicon—disappeared.”

Cinnamon also argues that the rest of the PV companies have been able to match Solyndra’s low-cost installation systems. To Cinnamon’s list, I would add that others have been able to match the company’s fabrication automation levels. But, it maybe is still too early to comprehend everything that went wrong or was neglected.

As to the current state of affairs, I leave the last words to Cinnamon:

“It’s a mistake to blame Solyndra’s problems on our lack of manufacturing commitment or relatively higher labor costs compared to China. Solar panels are commodities being sold on the worldwide market on a dollars-per-watt basis much as aluminum is sold on a dollars-per-kilogram basis. It is crystal clear that cheap and easy-to-install solar panels are exactly what the U.S. needs to reduce our energy costs and create installation jobs.”

CTT Categories

- Energy

- Manufacturing

- Market Insights

Related Posts

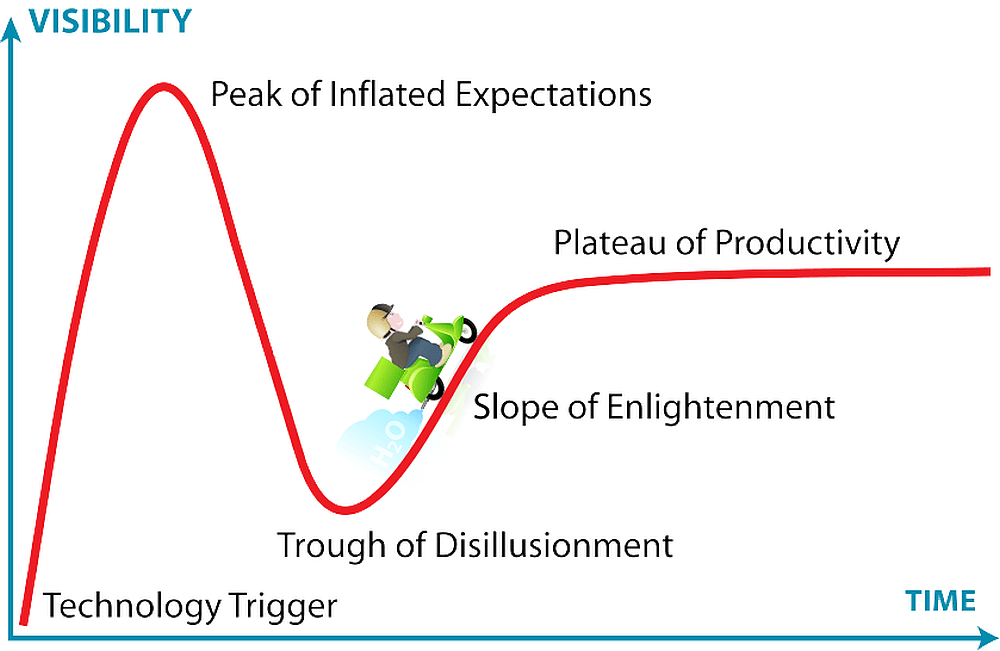

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025