Hmmm … FBI raids suggest PV company Solyndra had more problems than bad bets on silicon prices and superior installation systems.

No one seems to be revealing any cards at this point, but there is a lot of table talk. A story today in the WSJ.com [subscription req’d.] reports on some incongruous stuff:

The House Energy Committee has scheduled a hearing on the Solyndra bankruptcy next week, and two top Democrats called for Solyndra’s [CEO Brian] Harrison, to testify.

Reps. Henry Waxman of California and Diana DeGette of Colorado said Mr. Harrison had told them just two months ago that the company was in a strong financial position and at little risk of failing.

“At that time, he said the company was projected to double its revenues in 2011 [and] there was ‘strong demand in the United States’ for its shipments,” the Democratic lawmakers wrote in a letter to Rep. Stearns, chairman of the oversight subcommittee of the House energy panel. “These assurances appear to contrast starkly with his company’s decision to file for bankruptcy last week.”

Bloomberg delves further into DOE’s handling of the situation:

Agents for Energy Department Inspector General Gregory Friedman, who has called the department’s clean-energy loan program lacking in “transparency and accountability,” joined in the search yesterday at the Fremont, California, headquarters of Solyndra, which filed for bankruptcy protection on Sept. 6.

…

Friedman, a watchdog within the Energy Department, said in a March report that a lack of adequate documentation for loans “leaves the department open to criticism that it may have exposed the taxpayers to unacceptable risks associated with these borrowers.”

Harrison has been asked to testify Sept. 14 at a hearing before the US House Energy and Commerce committee.

CTT Categories

- Energy

- Market Insights

Related Posts

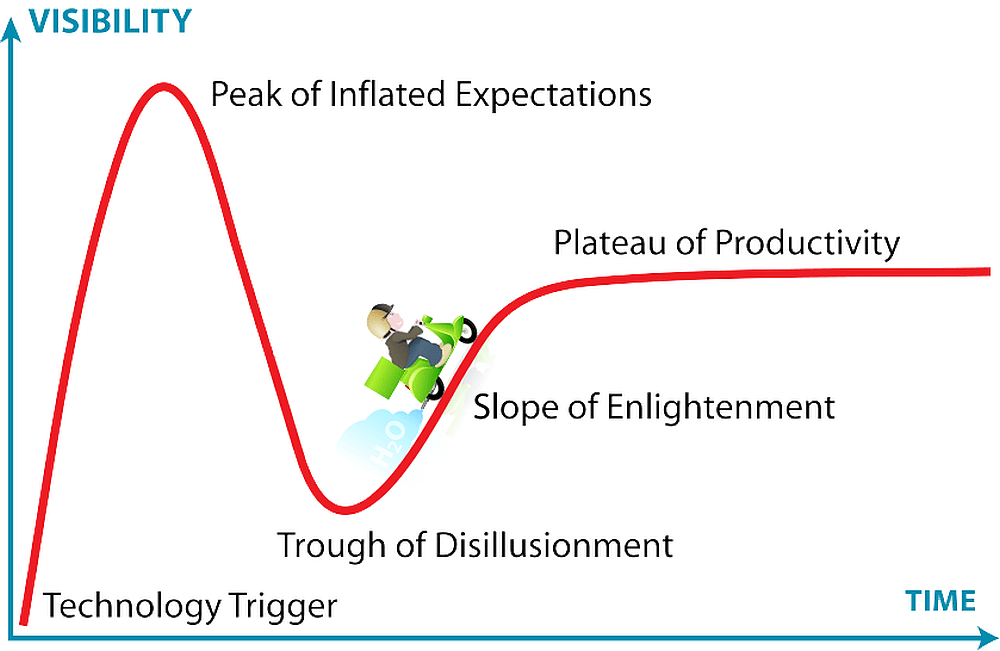

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025