Credit: Reinhard Jahn, used under Creative Commons license.

From the perspective of the U.S.’s strategic interests, this does not bode well. The USGS today reported that the value of unprocessed non-fuel minerals dropped about $14 billion to $57 billion in 2009. Likewise, the agency said that the value of processed/refined minerals dropped a whopping 25%.

I previously have lamented the lack of a responsibility and planning in the U.S. in regard to strategic materials. Today’s news reflects not only recessionary effects (e.g., declines in the housing and auto sectors) but also an alarming and still pervasive nonchalance about the nation painting itself into a corner by relying more and more on non-domestic sources.

A USGS release notes:

Also over the past year, U.S. dependence on foreign sources for minerals has increased, continuing a trend that has been evident for more than 30 years. The United States relied on foreign sources to supply more than 50 percent of domestic consumption of 38 mineral commodities in 2009, and was 100 percent reliant on imports for 19 of those.

Minerals are a fundamental component to the U.S. economy. Final products, such as cars and houses, produced by major U.S. industries using mineral materials made up approximately 13 percent (more than $1.9 trillion) of the 2009 gross domestic product.

The USGS has also just published its 2010 Minerals Commodities Summaries, aka, the USGS minerals yearbook.

CTT Categories

- Construction

- Energy

- Market Insights

Related Posts

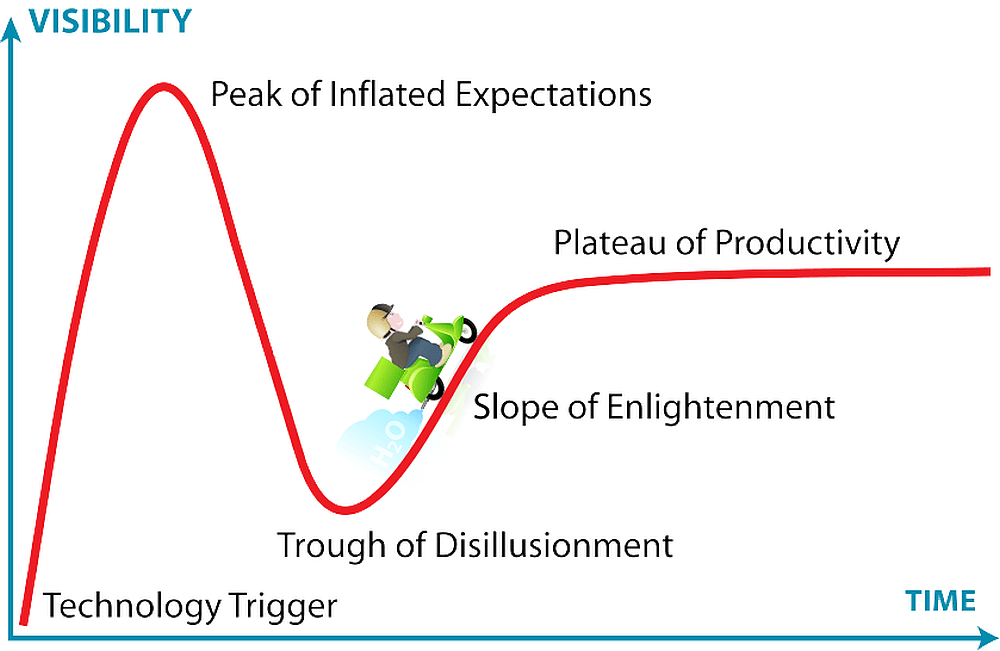

Hype cycles: The uphill climb for hydrogen bikes

June 26, 2025