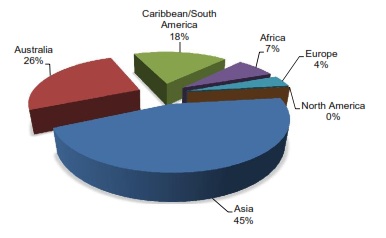

Global bauxite production. Asian supply has grown from 16 percent to 45 percent over the last decade. Credit: Roskill.

In what is probably good news for refractory ceramics producers, a new report from a UK-based market research company, Roskill, says that alumina refining and bauxite production have caught up—at least temporarily—with the disrupting surge in demand from Asia, particularly China, for feedstock for the aluminum industry.

China’s enormous appetite for bauxite and alumina has been a game-changer for at least the past five years, and with that demand, the market responded with higher prices in the 2007-09 period. Unfortunately for United States refractory makers, this was also the same timeframe in which they were just starting to benefit from more demand for their products from the steel industry. This effectively put a big squeeze on their profits.

Times changed, however, and the economic turbulence of the last half-decade eased some of the supply–demand issues. Demand particularly tapered in the West, though, according to Roskill, demand has remained fairly strong in China (in addition to big buying from businesses India and the Middle East).

But the lull in demand provided enough breathing space for bauxite producers to expand capacity. China, Indonesia and India have joined Australia as major producers (and Asia now accounts for 45 percent of global supply, compared with 16 percent a decade ago, reports Roskill).

Roskill says, “Global alumina production increased from 80 million tons to 96 million tons between 2007 and 2011, with most of the supply increase from China, which is now the largest producer. More refinery capacity is planned over the next three years, with another 14 million tons in China alone.” New production projects also are underway in Australia, Guinea, Ghana, Indonesia and Fiji.”

If all of the planned production comes online in the next three years, Roskill predicts that the market effectively shifts to an oversupplied state—at least in the short term.

Some of the above doesn’t necessarily impact refractory makers, who generally fret over the prices and supply stabilities of calcined bauxites. There tends to be fewer producers for this market. But, according to Roskill, “[N]ew sources of supply and expansions in Guyana and Brazil may ease fears of future shortages going forward.” The report also notes, “European supply of non-metallurgical bauxites has increased over the last five years, mainly through growing production in Greece, Turkey and Russia.”

Of course, the demand for refractory grade bauxite will continue to be connected mainly to the ups and downs of the iron and steel industry, but Roskill predicts that the shale gas/oil industry’s demand for proppants will also have a larger influence over supplies and prices than in previous periods.

Roskill’s website currently offers a discount of 15 percent for the entire report, but inquire first about this as this may have only applied to advanced-sales orders. Also, despite some conflicting information on some of Roskill’s web pages, the final version of the company’s report now available.